“Real Taxpayers of Nebraska” and increased state aid to K-12 education

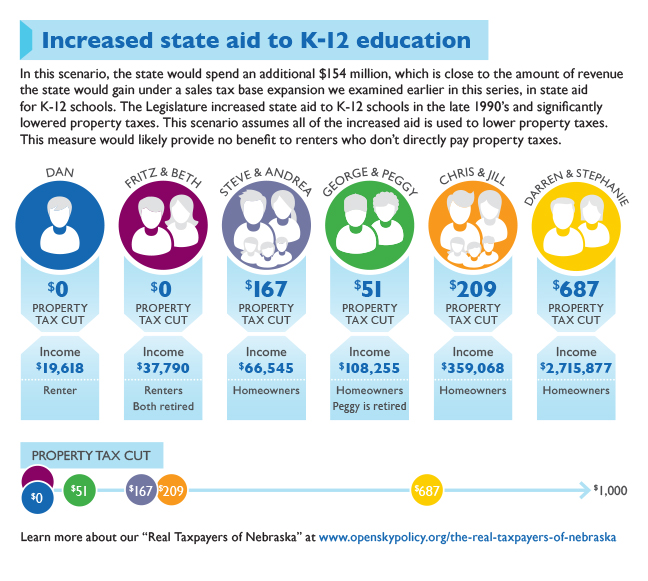

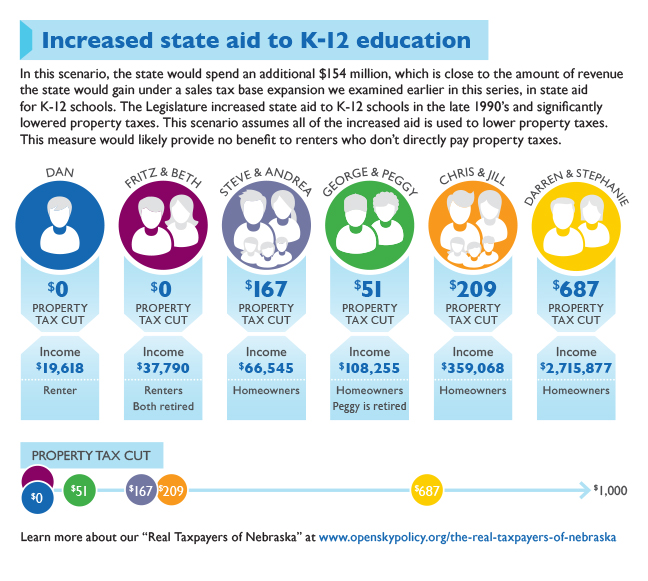

Today we’ll share an infographic that shows how infusing an additional $154 million in state aid to local governments such as school districts would affect our “Real Taxpayers of Nebraska.”

This infographic was modeled to cost nearly the same amount as the revenue that would be raised in the scenario we examined yesterday in which the state would expand the sales tax to include more services. Today’s scenario assumes all of the increased state aid is used to lower property taxes.

Nebraska has historically funded local governments at low levels relative to other states, a fact that was noted in the 1962 McClellan Study, the 1987 Syracuse Study and the 2007 Burling Commission Report. The Legislature increased state aid to K-12 schools in the late 1990s and significantly lowered property taxes. Since that time, state aid to schools has been cut and property taxes have steadily risen. Nebraska now ranks 49th nationally in terms of state aid to schools.

We recommend that the state increase aid to local governments to lower property taxes and help improve education equity. This infographic shows what this would mean to our taxpayers.

Download a printable PDF of this infographic.

More to come

In the coming days, we also will release infographics that show how our taxpayers would be affected by:

- Enacting a “property-tax circuit breaker.” We recommended the state enact a circuit breaker as it is a targeted form of property tax assistance and is the only option we reviewed that was able to extend property tax assistance to renters.

- Increasing the state’s property tax credit. We recommended the state use a more targeted form of property tax assistance like a circuit breaker.

- Cutting the top income tax rate to 5.75 percent. We recommended that the state not lower income rates as this wouldn’t spur economic growth but would make our tax code significantly more regressive.