Policy brief: The gas tax and inflation

Building and maintaining a strong transportation network is critical to sustained economic growth and vitality in our state. However, the value of the gas tax has not kept up with the rising costs of construction necessary to make these important investments in our roads and bridges.

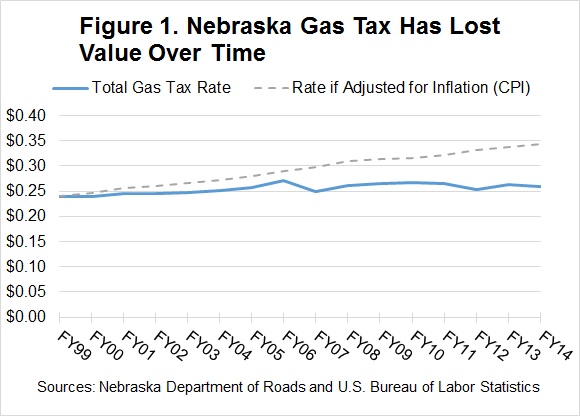

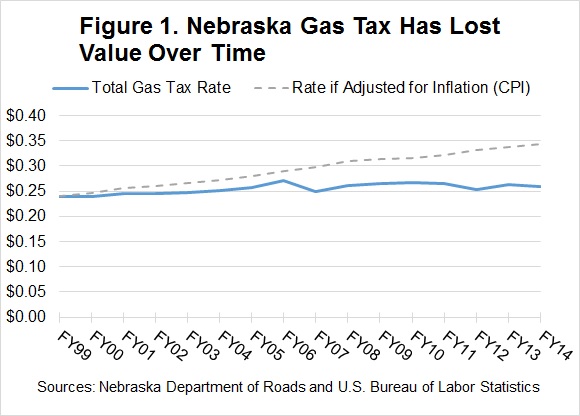

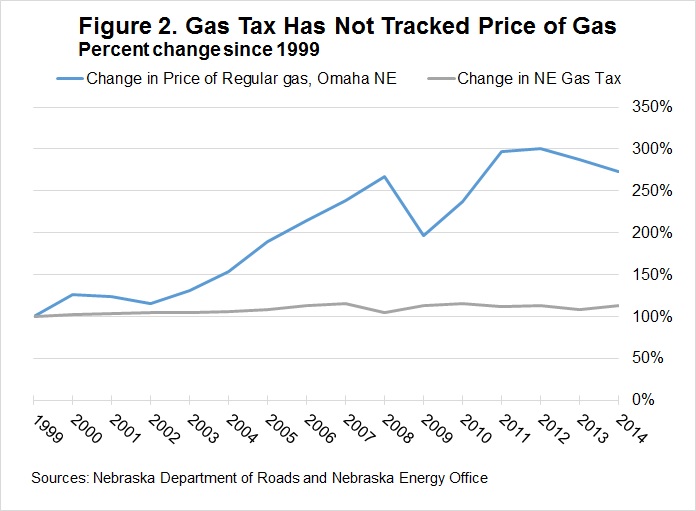

Adjusting for inflation, the gas tax rate has declined more than eight cents since Fiscal Year 1998-99 (Figure 1).

The gas tax in Nebraska consists of:[1]

- A fixed tax set in statute;

- A wholesale portion, based upon 5 percent of the average wholesale cost of fuel in the previous six-month

period; and

- A variable portion, set by the Director of the Nebraska Department of Roads, at an amount to meet the appropriations made from the Highway Cash Fund by the Legislature.[2]

The overall tax rate on motor fuels can be adjusted every six months based upon any changes in the wholesale and variable portions. The fixed rate has been set at 10.3 cents since July 2009, when it was lowered slightly in conjunction with the implementation of the wholesale portion. Before that, the fixed rate was set at 12.5 cents since January 1993.

The wholesale and variable portions of our state’s gas tax have fluctuated over the years but have failed to index our gas tax relative to the price of gasoline (Figure 2) or inflation (Figure 1). Instead, changes in the wholesale rate and variable rate have generally offset each other, holding the total rate relatively constant.

The Institute on Taxation and Economic Policy (ITEP)[3] recommends that gas taxes be increased to reverse their long-term declines – such an increase would occur under LB 610.

Download a printable PDF of this analysis.

period; and

period; and