Policy brief – Tax Day update on the federal tax cuts

In recognition of Tax Day, we want to provide an update on the recently passed federal tax cuts and their impact at the federal, state and individual taxpayer levels.

The tax cuts were signed into law in December and made a number of changes to the Internal Revenue Code. The law was drafted hurriedly and tax experts are still deciphering its implications for taxpayers and tax revenues. We do know, however, that it offers big tax breaks to large corporations and the very wealthy with only modest benefits for low- and middle-income Nebraskans.

Wealthiest 1 percent get almost a third of Nebraska’s share of the tax cut

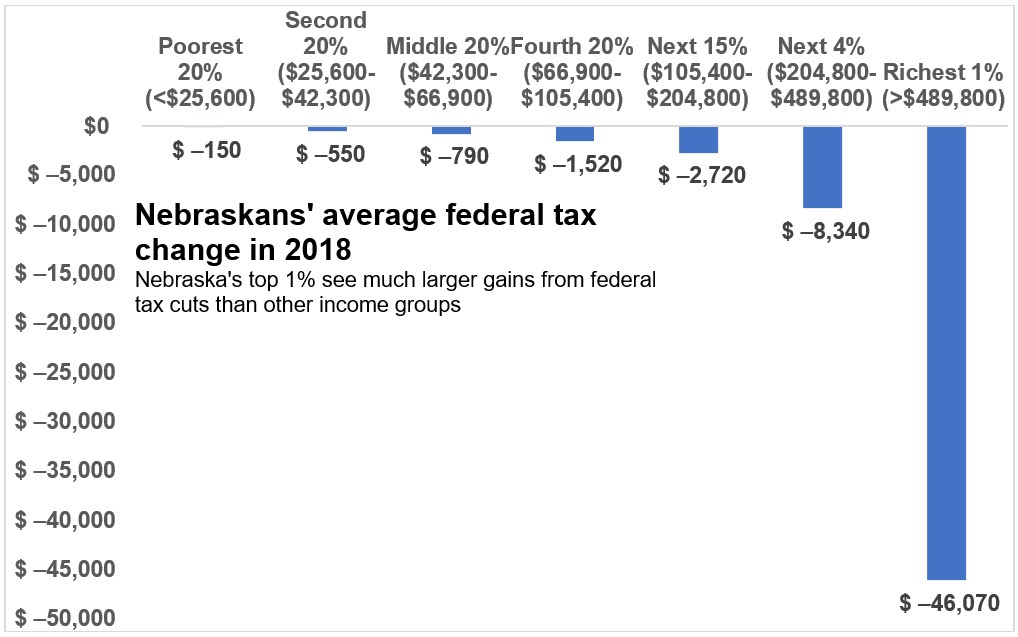

According to the most recent report from the Institute on Taxation and Economic Policy (ITEP), in 2018, 27 percent of the tax cuts going to Nebraska will accrue to the top 1 percent of the state’s earners, whereas the poorest 20 percent of Nebraskans will only reap 2 percent of the state’s share of the tax cuts.[1] In 2018, the average tax cut for the top 1 percent of Nebraskans is $46,070 (3.5 percent of pre-tax income), whereas the average tax cut for those in the bottom 20 percent is only $150 (1 percent of pre-tax income). The middle 20 percent of Nebraska taxpayers do somewhat better than the bottom 20 percent, with an average tax cut of $790 (1.5 percent of pre-tax income) and 9 percent of Nebraska’s share of the tax cuts in 2018.[2] (See chart)

Making temporary changes permanent would be costly

Many of the provisions in the federal tax cuts that help low- and middle-income families are set to expire after 2025, whereas many of the provisions that impact wealthy taxpayers, such as the corporate income tax rate cut, are permanent under the law. Proponents of the tax cuts argue that all Americans should support extending the provisions of the law that are temporary so as to provide permanent middle-class tax cuts. Of course, extending the tax cuts will increase their cost, which are already projected to reduce revenue by $1.1 trillion.[3] For 2026 alone, extending the temporary provisions will cost approximately $251.7 billion.[4]

Low-income earners would see tax hikes if temporary changes become permanent

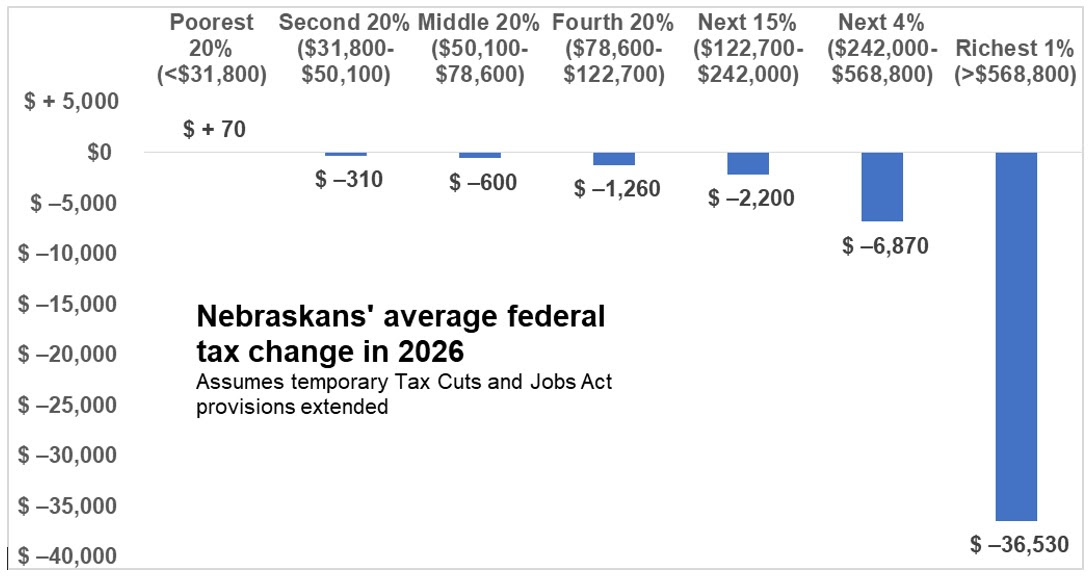

Further analysis from ITEP shows that extending the temporary provisions would be no more helpful to the middle class than what’s observed in the distributional analysis for 2018.[5] For all income groups, the average tax cut from the federal changes is lower in 2026 than in 2018, even with the temporary provisions extended. This is because the business tax provisions in the new law provide less generous tax breaks over time, and because the tax cuts are partly offset by tax increases due to the repeal of the ACA mandate, changes to health insurance subsidies, and a shift to a slower-growing calculation of inflation in the Internal Revenue Code. However, Nebraska’s most affluent would still see a considerably larger benefit than low- and middle-income Nebraskans. If the temporary provisions were extended, by 2026, the middle 20 percent of Nebraska taxpayers would see an average tax cut of $600, which is $190 less than their tax cut in 2018 (1 percent of pre-tax income) and the poorest 20 percent of Nebraskans would, on average, actually see a tax hike of $70 (0.4 percent of pre-tax income). Conversely, the wealthiest 1 percent of Nebraskans would see an average tax cut of $36,530 (2.4 percent of pre-tax income) in 2026. (See chart)

Tax cuts threaten funding for critical services

In addition to the regressive effects on Nebraska residents and the likelihood that many low-income Nebraskans would see tax increases, the federal tax cuts jeopardize critical funding that the state receives from the federal government. According to the Joint Committee on Taxation, the tax cuts are expected to cost approximately $1.5 trillion over the next decade and only improve economic growth enough to make up about a quarter of this revenue loss in new revenue.[6] About 30 percent of the state budget is paid for with federal dollars, and to the extent that federal budget cuts are made to pay for these tax changes, reduced federal funding could potentially force state-level budget cuts.

Conclusion

Rather than extend the temporary provisions and the regressive effects of the law as-is, Nebraskans would be better served by federal lawmakers working toward more fiscally responsible policies, like targeting family tax benefits such as the child tax credit to those who really need them, instead of putting critical government services at-risk in order to pay for tax cuts for the wealthy and large corporations.

Download a printable PDF of this analysis.

Benefit the Wealthy,” downloaded from https://itep.org/tcja20182026/ on April 13, 2018,