Policy brief — LB 420 and property tax circuit breakers

Property tax “circuit breakers” like the one proposed in LB 420 – a bill before the Legislature’s Revenue Committee — are a way to provide targeted tax reductions to those whose property taxes are high relative to their incomes. They are called “circuit breakers” because the income tax credits are triggered once property taxes reach a certain percentage of a person’s income, similar to how electrical circuit breakers are triggered when electricity surges. The income tax credit helps offset the cost of property taxes.

What LB 420 does

LB 420 creates a residential refundable income tax credit and a separate agricultural refundable income tax credit. The intent is to use funding currently dedicated to the state’s Property Tax Credit Program to pay for LB 420’s circuit breaker provisions. The overall amount for the residential circuit breaker would be capped at $82.7 million and the agricultural circuit breaker would be capped at $107.6 million.[1]

About the residential circuit breaker

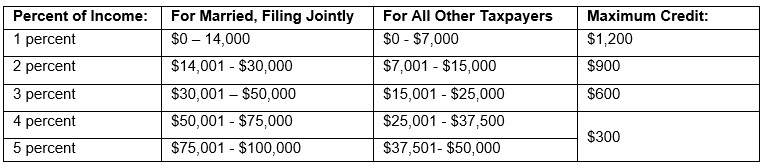

LB 420’s residential circuit breaker would go to taxpayers with Adjusted Gross Income (AGI) less than $100,000 who rent or own their primary residence in Nebraska. For homeowners, the credit calculation is based on the property taxes paid on the value of their home.[2] For renters, the circuit breaker assumes that 20 percent of their rent goes toward the landlord’s property taxes. As income increases, the circuit breaker credit calculation assumes that taxpayers can afford to spend more of their income on property taxes. Qualified taxpayers would receive refundable income tax credits equal to the amount of their property taxes that exceed the set percent of income, up to the maximum amount of credit, as detailed in the table below.

About the agricultural land circuit breaker

The agricultural land circuit breaker in LB 420 would be available to individuals who own agricultural land or horticultural land that is a part of a farming operation that has a federal AGI of less than $350,000. The tax credit would be calculated based upon the amount by which the agricultural property taxes paid exceed seven percent[3] of farm income.

Impact on taxpayers

Under LB 420, a couple that earns $82,421 annually and pays $4,477 in property taxes would receive a $300 income tax credit. The same family currently receives a $264 tax credit under the existing Property Tax Credit Program. A couple that rents, earns $15,025 annually and pays $902 in property taxes[4] would get a $742 income tax credit under the circuit breaker but receives no direct property tax reduction under the existing Property Tax Credit Program. A couple that earns $141,303 annually and pays $1,426 in property taxes would not receive an income tax credit under the circuit breaker, but they do presently get $81 under the Property Tax Credit Program. A couple that owns agricultural land, earns $85,081 and pays $50,033 in agricultural land property taxes would receive a $44,077 income tax credit under LB 420, or a proportional amount if the credits claimed exceed the amount of the cap.[5] The couple receives $3,536 under the current Property Tax Credit Program.[6] This same couple’s residential property taxes are $3,512. Under LB 420, they would receive a $300 income tax credit for their residential property as opposed to the $191 they receive from the current Property Tax Credit Program.

Circuit breaker use in other states

In 2018, 18 states and the District of Columbia offered circuit breaker programs that targeted property tax relief based upon the relationship between property taxes and income.[7] Thirteen other states provide property tax credits for low-income families based on income only, without consideration of the property tax-to-income relationship.[8]

Conclusion

Property tax circuit breakers have garnered support across the country and in Nebraska. They were mentioned as a possible solution to Nebraska’s property tax challenges in the Tax Modernization Committee Final Recommendations in 2013[9] and in a December 2014 Revenue Committee report on property taxes.[10] As the state looks at ways to provide property tax relief, LB 420 provides targeted property tax reductions to those who need it most.

Download a printable PDF of this analysis.