$136.3 Billion

The Institute on Taxation and Economic Policy (ITEP) recently released their analysis on the Educational Choice for Children Act, (ECCA) federal legislation introduced by Rep. Adrian Smith of Nebraska to offer dollar-for-dollar income tax credits for charitable donations to nonprofits that distribute vouchers to K-12 private schools. ITEP finds that this legislation would cost $136.3 billion over the next decade. The ECCA is similar in mechanism to LB 753 passed in 2023, which Nebraskans initiated a successful referendum to repeal. That referendum did not make it to the ballot, as LB 753 was repealed by subsequent legislation, LB 1402, which appropriated funds for private schools directly from the state’s General Fund. LB 1402 bill was successfully repealed via referendum in the November 2024 general election.

ITEP also outlines the likelihood of tax avoidance under the ECCA, with donors being able to reduce their tax liability by making contributions of appreciated stock to avoid capital gains tax. Donating stock to a scholarship granting organization would lead to an additional $8.2 billion in losses to the federal coffers over the next 10 years. In 2018, for example, a change in federal law ramped up the profitability of a tax shelter facilitated by a voucher tax credit in Arizona. Prior to that change, the full allotment of tax credits in the state took about six months to claim. After the change, it took just two minutes.

ITEP’s analysis includes a state-by-state breakdown of projected loss of revenue in the first year as well as over the next 10 years, solely from the capital gains avoidance made possible by ECCA. They project that the state of Nebraska would lose $400 million in the first year and $5.3 billion over the next decade. For reference, that equates to 6,807 teachers earning the state average salary in Nebraska in the first year of ECCA implementation.

49

Proposed cuts to school meal programs at the federal level would create additional obstacles for access in 49 Nebraska schools, according to analysis by the Center on Budget and Policy Priorities (CBPP). The Community Eligibility Program (CEP) allows schools where there is a significant number of students from low income families to offer free meals to all students, rather than asking individual families to apply. The reimbursement from the federal government for these meals is determined by comparing other means-tested programs, like the Supplemental Nutrition Assistance Program, to determine the total share of students experiencing poverty. Under current federal guidelines, schools can adopt CEP if at least 25% of students receive these benefits.

Congress is currently considering raising that threshold to 60%, which would impact 49 schools across 23 school districts in Nebraska, including both public and private K-12 schools. The total enrollment at these schools is 12,432 students. This would decrease the impact of CEP in Nebraska significantly, where 18% of schools participating in the school lunch program have adopted the program, reaching 70,821 students each day. Access to nutritious school meals has been found to improve concentration in the classroom and a range of other educational outcomes.

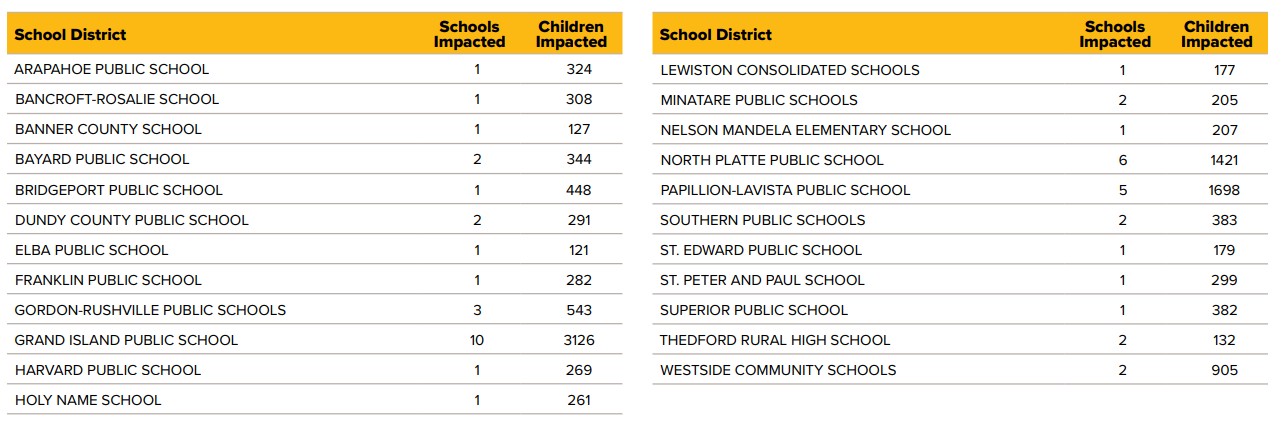

Schools and districts that would be impacted by a shift from 25% to 60% for CEP eligibility, according to CBPP:

74,387

Last year 74,387 people experienced the scenic Niobrara River, which flows across northern Nebraska, via the Niobrara National Scenic River Visitor Center on Highway 20 near Valentine. The Center offers information on the history and unique ecology of the area, as well as providing connections with local businesses that provide canoe and tube rentals. Local Nebraskan George Johnson invested nearly half a million dollars and years of work to construct the Center according to federal specifications, according to reporting by the Flatwater Free Press. However, he abruptly received notice recently that the 13-year lease on the property would be terminated, more than a year ahead of schedule.

This was part of a larger, nationwide effort that included more than two dozen lease terminations at the National Park Service, led by the The Department of Government Efficiency (DOGE) driven by billionaire Elon Musk. Five additional buildings in Nebraska were also targeted for lease cancellations, but one, the Edward Zorinsky Federal Building in downtown Omaha, was removed from the list prior to it being deleted entirely.