$7.69 billion

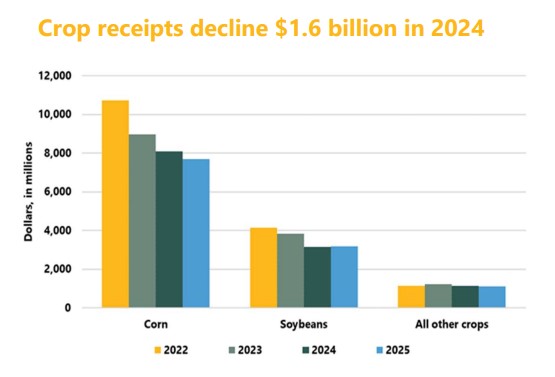

Economists estimate that Nebraska’s 2

This is despite higher production levels, including a 9% yield increase for corn and a 16% boost for soybeans. There is also some encouraging news for cattle receipts, which are expected to increase $1.09 billion, or by 7% in 2024. Economists point to persistent declines in commodity prices for the overall decline, including a 17% decrease in corn and 22% decrease in soybean prices.

Cow-calf operators can be optimistic. With improved forage conditions, inventory is projected to grow modestly in 2024. Supported by higher prices and stable marketings, cattle receipts are expected to continue to increase into 2025.

$948 million

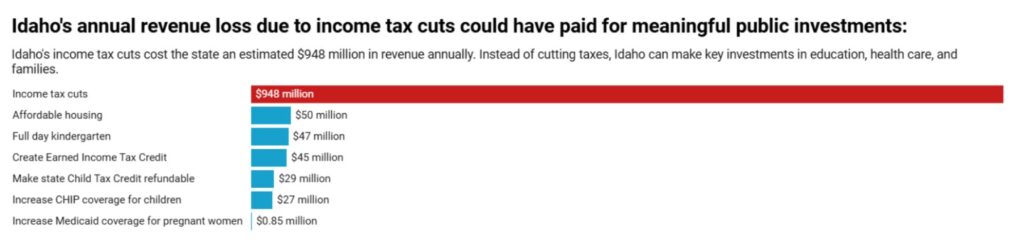

Idaho is one of several states facing significant budget shortfalls after enacting aggressive income tax cuts over the last few years. From FY 2022 to FY 2024, Idaho lost nearly $1.9 billion dollars in revenue due to income tax cuts. The state is projected to lose an additional $948 million dollars in FY 2025 onward annually, resulting in a cumulative total of $2.8 billion dollars in annual revenue loss as of FY 2025. This tax cut is also highly regressive. The bottom 20% of wage earners will see about $27 in annual tax savings, compared to the $15,049 that highest earners will pocket, according to the Idaho Center for Fiscal Policy.

Idaho prioritized income tax cuts benefiting the wealthiest over other state investments in the economy such as affordable housing, increased medical coverage for low-income children, or increased Medicaid coverage during pregnancy.

Nebraska has also undertaken large, regressive income tax cuts, which are putting pressure on the state’s revenues. The Nebraska Economic Forecasting Advisory Board met yesterday and reduced expected FY25 tax receipts by $141 million.

60%

A survey from the Midwest Newsroom and Emerson College indicated that 60% of Nebraskans oppose using state taxpayer funds to help private schools. The survey included 1,000 Nebraskans with weighted responses to reflect voter demographics across the state. This was more than twice the percentage of Nebraskans who support the concept, at 29%, with 12% saying they were unsure.

The survey also asked participants to weigh in on whether they believe their elected representatives were making decisions in the best interest of the state, or if they are mostly motivated by their own interests. Among Nebraska voters, 58% responded that they thought their elected officials were motivated by self interest, a slightly higher percentage than the other three Midwestern states surveyed: Kansas, Missouri and Iowa.

4

Four days remain until the November 5, 2024 Presidential election, which will not only decide our country’s next leader, but dozens of other key roles in the Nebraska legislature, utility boards, the State Board of Education, Board of Regents and other roles.

To find your polling place or check on the status of your absentee ballot, click here.

For more information on Nebraska’s new Voter ID law, including a list of acceptable documents and what to do if you do not have your ID on election day, click here.

To read more about the candidates and ballot initiatives, including their answers to questions posed by the League of Women Voters, click here.

If you need a ride to the polls on election day, here’s a good list of options for the Omaha and Lincoln areas, some at low or no cost.

If you encounter any difficulty exercising your right to vote, feel intimidated in any way, or observe inappropriate or illegal behavior at the polls, call 866-OUR VOTE.