Nebraska Income Tax Expenditures

Personal Income Tax Expenditures (PIT)

For both individual taxpayers and businesses

Nebraska Itemized Deductions — Taxpayers can choose Nebraska standard or federal itemized deductions based on which deduction is larger. Does not include federal deduction for Nebraska income taxes paid.

Nebraska Standard Deduction — Taxpayers can choose the standard deduction for their filing type; amounts are tied to federal amounts. Nebraska’s standard deduction in 2012 was $5,950 for those who are single or married filing separately; $11,900 if married, filing jointly; and $8,700 for heads of household. 34 states use standard deductions. Nebraska is one of 10 states that tie their standard deductions to federal amounts. Three states – New York, Rhode Island and Connecticut — have higher standard deductions than Nebraska.

State Income Tax Refund — Subtraction for state income tax refunds from federal adjusted gross income (AGI).

Non-Nebraska S Corporation Income/Loss Deduction — Exclusion from federal AGI, S Corp income that is not connected with Nebraska sources.

For individual taxpayers only

Resident of Two States — Reduction for dual-state residents for tax on income subject to tax in both states, provided the other state offers a similar reduction.

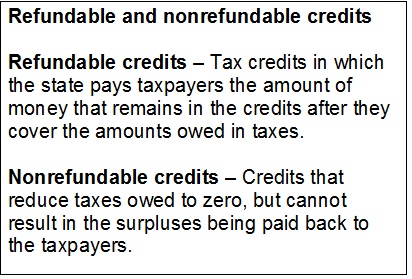

Nebraska Personal Exemption Credit – Nonrefundable inflation-adjusted credit that was $123 per Nebraskan for 2012 for every taxpayer and dependent.

Credit for Tax Paid to Another State — Credit against income tax imposed on Nebraskans by another state on income from sources also subject to Nebraska income tax.

Refundable Earned Income Credits — Credits for low-income residents equal to 10 percent of the federal earned income credit.

Credits for Child/Dependent Care — Credits to help pay for child and dependent care. A nonrefundable credit is allowed if federal AGI is greater than $29,000, in an amount equal to 25 percent of the federal credit. A refundable credit is allowed at lower incomes, ranging from 30% – 100% of the federal credit.

Credit for Elderly and Disabled — A nonrefundable credit for low-income elderly and the disabled.

IRC Section 1341(A)(5) Exclusion — Deduction for repayments of income that was received mistakenly in prior years.

Nebraska Long-Term Care Savings Plan — Deductions for contributions to the Nebraska Long-term Care Savings Plan.

Dividends and Capital Gains Deduction — Deduction of dividends and/or capital gains from sale or exchange of stock acquired because of employment by a company or during employment by the company.

Nebraska income tax liability after nonrefundable credits no greater than federal income tax liability before credits — A taxpayer with less than 5,000 in adjustments increasing income will not have a Nebraska tax larger than their federal tax.

Individual and Fiduciary Income Tax Rates – Income taxed at rates other than the highest rate.

Corporate Income Tax Exemptions (CIT)

For businesses only

Credit for In-lieu-of Intangible Tax Paid — Credits for insurers, electric cooperatives, or credit unions for certain in-lieu-of intangible taxes paid.

Corporation Allocable Income — Corporate taxpayers can deduct allocable/non-apportionable income.

Subtraction for Foreign Income Taxed in Excess of Maximum Federal Tax Rate — Subtraction for corporate income taxed in another country at a higher rate than the maximum U.S. federal rate.

Corporation Net Operating/Capital Losses (NOL’s) — Businesses can deduct losses from prior unprofitable years from their current profits.

Insurance Company Tax Rates — Insurance companies pay the lower of a) Nebraska’s lowest CIT rate, or b) the rate in their home state if that state imposes “retaliatory” taxes on Nebraska insurance companies.

Corporate Income Tax Rates — Preferential rates for lower incomes, compared to taxing all income at the highest rate.

Exemptions from both PIT and CIT

For both individual taxpayers and businesses

Beginning Farmer Tax Credit — Refundable credit for new farmers.

Community Development Tax Credit — Tax credits for contributions to certified community betterment programs.

Income Tax Credit for Investment in Biodiesel Facility — A nonrefundable credit is allowed for a taxpayer investing in a biodiesel facility.

Foreign Dividend Subtraction — Deduction for dividends received from international companies not subject to the IRS code.

Interest and Dividends on U.S. Obligations — Federal law prohibits state taxation of income from interest/dividends paid on most federal savings bonds and other federal obligations.

Contributions to Nebraska Educational Savings Plan Trust — A deduction for donations into the Nebraska Education Savings Plan Trust.

Angel Investment Tax Credit – Refundable credit for investors in certain start-up companies.

For businesses only

Renewable Energy Tax Credit — Tax credits or refunds for electricity producers who use zero emission facilities.

LB775 (Tax Incentive) Credits — Tax credits or refunds for qualified corporations. Businesses must meet certain hiring and investment benchmarks. New applications no longer accepted.

Quality Jobs Act Credits — Incentives for corporations beyond those received under LB 775. Businesses must meet certain hiring and investment benchmarks. New applications are no longer being accepted.

Invest Nebraska Act Credits — Incentives for corporations that make investments of $10 million and above and offer wages higher than the state average.

Nebraska Advantage Act Credits — Incentives for businesses that meet certain investment, hiring and/or retention benchmarks.

Nebraska Advantage Rural Development Act Credits — Income tax credits for businesses that buy property or hire in rural Nebraska.

Nebraska Advantage Research and Development Act Credits –Tax credits or refunds for businesses that invest in research in Nebraska. Credit increases if investment is at state college or university.

Nebraska Advantage Act Microenterprise Tax Credit Act — Incentive for creation or expansion of small businesses.

Credits for Franchise Tax Paid by Financial institution — Nonrefundable credits for partners, S corporation shareholders, LLC members, or estate and trust who have ownership in a financial institution.

Net Operating Losses — Businesses can deduct losses from prior unprofitable years from their current profits.