Most Nebraskans who claim the state income tax credit on property taxes paid to public schools will see little change in what they pay resulting from the tax package to be debated today, the final day of the Legislative session.

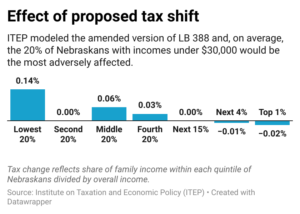

But for Nebraska’s lowest-income earners – households making less than $30,000 annually – the impact of proposed changes to the sales tax base and to some excise taxes will, on average, be greater than any savings that they might see through property tax reductions or an increase in the Earned Income Tax Credit on their state income tax return.

An amended version of LB 388, to be debated on Thursday, would direct additional revenue from sales taxes to a new School Property Tax Credit Fund that would reduce the next round of property tax bills by a combined $750 million, while increasing that amount by $30 million in later years.

The new credit on property tax statements would replace the existing LB 1107 state income tax credit on property taxes paid to schools and community colleges. In tax year 2023, $561 million was set aside for these income tax credits on taxes paid to K-12 schools.

For most individual taxpayers, the impact of the proposed tax change comes down to two questions: Do they own property? And, if so, are they claiming the state income tax credit on those property taxes paid to public schools? In tax year 2021, more than one-third of the credits went unclaimed.

LB 388, as amended, guarantees that all property taxpayers would benefit from the money that the state has set aside to pay for the income tax credits over recent years. By “front loading” the credit, those funds would instead be sent directly to counties and shown as an annual deduction on property tax statements. As with the existing income tax credit, the property tax credit that a taxpayer receives would be proportional to what they would have paid in property taxes to fund their local public schools.

The bill does not change the amount of state and local funding going to public schools, but it does make slight changes to revenue caps on school districts. Under LB 388, those revenue caps would be extended to cities and counties as well, impacting their ability to respond to rapid growth or budget implications from decisions at the state level such as this year’s $15 million cut in behavioral health services.

LB 388 does not include an increase in the overall sales tax rate but instead raises revenue through repeal of existing exemptions on pop and candy ($36 million in new revenue in FY 25), pet grooming and veterinary services ($18M), Lottery tickets ($10M) and dry cleaning ($3M). It creates a new tax structure on digital advertising services ($46M), hemp and CBD products ($4M) and raises taxes on vaping products ($21M) and cigarettes ($1M).

Putting additional funding toward property tax cuts slightly reduces the regressivity of the property tax system in Nebraska. And the first expansion of the state-level Earned Income Tax Credit in over a decade will increase the progressivity of the income tax system. Under LB 388, the state EITC would grow from 10% to 15% in tax year 2025.

An estimated 121,000 households in Nebraska would benefit from the EITC expansion, putting additional cash into the hands of low-wage working families. To qualify, a taxpayer has to have worked in the year for which the credit is being claimed, with annual income limits ranging from $24,210 for a couple with no children filing jointly this year to $63,398 for couples with three or more kids.

As policymakers consider tax changes going forward, several additional options are available to address the comparatively high tax burden of Nebraska’s low-wage earners, including adoption of a state-level Child Tax Credit, removal of additional existing sales tax exemptions to reduce the overall sales tax rate, as well as circuit breakers and homestead exemptions that target a property tax cut to those who need it most.