Tax cuts proposed for wealthy Nebraskans and out-of-state corporations

LB 754 proposes to lower the state’s top individual and corporate income tax rates to 3.99% by 2027.

Who benefits?

- Modeling suggests that three-quarters of the personal income tax benefit will go to the top 20% of Nebraska wage earners. The bottom 20% would see cuts averaging $5.

- And because of how Nebraska taxes corporations, it’s estimated that 83% of the corporate tax cut will flow out of state.

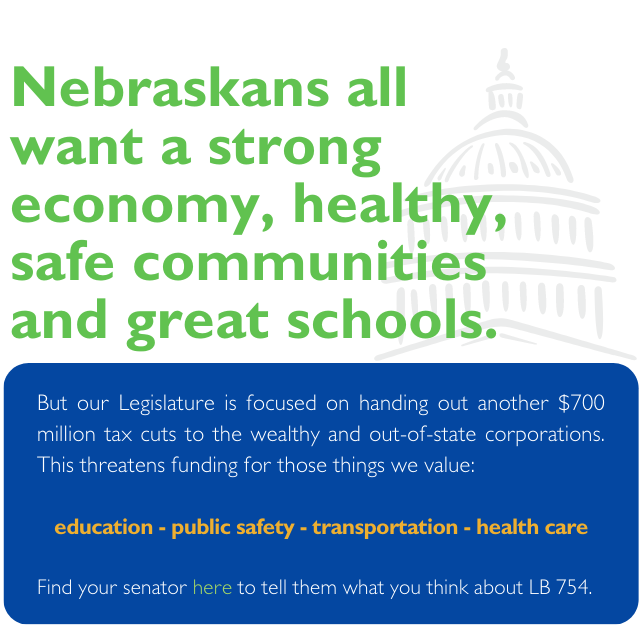

These proposed tax cuts, on top of cuts that the Legislature enacted a year ago, will cost the state millions of dollars in revenue that could one day threaten the essential services that make Nebraska a great place to work and live.

If the intent is to return some of Nebraska’s current budget surplus to taxpayers, there are other mechanisms available that could be better targeted to those in need of financial relief now without tying the hands of future Legislatures.

Tell your state senator what you think of LB 754

Updates from OpenSky

Modeling details how amended tax package would impact Nebraskans

Most Nebraskans who claim the state income tax credit on [...]

Fair taxes are key to thriving communities

Today is Tax Day, the day when your income taxes [...]