After repeated attempts to pass school privatization measures had failed, Nebraska lawmakers in 2023 approved LB 753, which creates dollar-for-dollar tax credits totaling up to $100 million for donations to organizations granting private school scholarships.

This month, OpenSky Policy Institute has reviewed the key components of LB 753, including a look at the cost of the program, the scholarships and the tax credits that are funding them, as well as the scholarship granting organizations (SGOs).

This month, OpenSky Policy Institute has reviewed the key components of LB 753, including a look at the cost of the program, the scholarships and the tax credits that are funding them, as well as the scholarship granting organizations (SGOs).

Today’s final post explores the private schools accepting the taxpayer-funded scholarships.

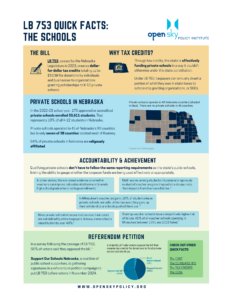

Breakdown of public and private schools

Beginning in 2024, taxpayers can annually divert a portion of what they owe in state taxes to SGOs, which in turn will award scholarships to eligible students attending a private school. This mechanism, set out in LB 753, provides an avenue for the state to fund private schools in a way it couldn’t otherwise under the state constitution that prohibits appropriations to non-public schools.

In Nebraska, 90% of K-12 students attended public schools in 2022-23. To be accredited, the 244 public school districts must follow Nebraska Department of Education regulations and procedures spelled out in Rule 10. Requirements unique to public schools include incorporating writing experience into all areas of curriculum at each grade level, including career education in middle school and a school improvement plan to address quality learning, equity and accountability.

The 175 private schools approved by the Nebraska Department of Education enrolled 33,611 students. Those private schools operated in 45 of the state’s 93 counties but in only seven of 38 counties located west of Kearney. Private schools must comply with provisions of Rule 14. They’re allowed larger average class sizes than public schools, and a smaller percentage of private school teachers are required to teach classes in their areas of specialty.

Tracking spending accountability

Unlike public schools, private schools are not required to admit a student, even if an SGO has awarded the student a scholarship. LB 753 says that the state has no additional authority to “influence the governance or policies” of schools whose students are receiving taxpayer-funded scholarships. Qualifying schools cannot discriminate on the basis of race, but can reject students on a number of other provisions, such as how they style their hair, what they wear or how they perform on tests.

The private schools benefiting from taxpayer-funded scholarships are also not held to the same accountability and reporting requirements as the state’s public schools, limiting the ability to gauge whether the funds are being used effectively or appropriately.

In other states, similar taxpayer-funded scholarship programs have led to “pop-up schools,” new private schools that open and close at an alarming rate. In Wisconsin, 41% of schools participating in a Milwaukee-based school privatization program closed between 1991 and 2015.

Meanwhile, several private schools across Iowa hiked their tuition this year as the state’s expanded school privatization measure kicked in. Analysis from a national sample of tax returns found that taxpayer-funded support would incentivize existing private schools to raise tuition.

In a survey conducted this spring, voters said a lack of spending accountability was both a bad and likely outcome of LB 753 in Nebraska.

Tracking student achievement

The taxpayer-funded scholarships introduced in LB 753 mirror tax credits rolled out in other states, and evidence that students “do better” when they receive the scholarships is mixed at best.

Much of the research on the performance of school privatization programs is supported by the private school industry. Rigorous independent research of these programs, however, reveals examples where academic achievement has suffered.

In Louisiana, academic results in a statewide school privatization program were described as “catastrophic,” with test score drops larger than Hurricane Katrina’s impacts on academics in New Orleans. A study of elementary and middle school students in Indiana revealed that those in their first year of attending a private school lost ground in mathematics when compared to their public school peers.

In Wisconsin, which enacted a school privatization program in Milwaukee in 1990, reading and math scores in private schools 30 years later were no better than scores in Milwaukee public schools.

There’s no requirement in LB 753 that the private schools in Nebraska that accept taxpayer-funded scholarships provide information on the academic performance of recipients.

Signature-gathering effort wraps up

On Wednesday, Support Our Schools Nebraska, a coalition of public school supporters, will turn in signatures gathered in a referendum petition campaign to put LB 753 before voters in November 2024.

Read more on LB 753 at openskypolicy.org.