The dollars and cents of LB 753 don’t add up for strong K-12 schools that support all Nebraska students.

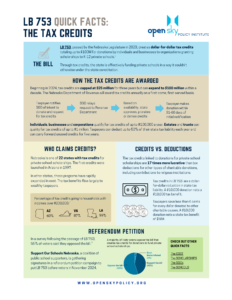

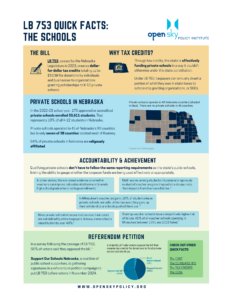

After multiple failed attempts to introduce school privatization in Nebraska, the Legislature in May passed LB 753, a bill providing state tax credits for donations to organizations granting scholarships to students attending private schools.

Nebraskans take pride in strong education systems that make our communities better places to live, raise a family and start a business. Here’s an overview of what LB 753 could mean in Nebraska.

Tax credits will drain taxpayer money from public education

The dollars sent to private schools through LB 753 would otherwise be tax dollars available to help public schools in addressing teacher shortages and to fund vocational and technical education programs fundamental to meeting workforce demands.

The Legislature’s own analysts have predicted that we could see an $11 million reduction in state aid to schools if 5,000 students attending the state’s largest districts end up transferring to private schools. And that’s on top of the $25 million in revenue that the state stands to lose through these tax credits each year.

Under LB 753, the tax credits could grow to $100 million a year, or about one-tenth of the state’s annual General Fund appropriation to public schools.

Currently, Nebraska ranks near the middle of the pack among states on what it spends overall to educate each K-12 student. Diverting state revenue from public schools doesn’t make sense when the goal should be to improve student outcomes for everyone.

Taypayer-funded scholarships are unaccountable

Once the private schools receive money from the taxpayer-funded scholarships, there’s no accountability for how that money is spent. Participating schools must comply with requirements for private schools established by the State Board of Education, but there’s no evaluation measure for students’ academic outcomes that public schools conform to.

And unlike public schools, private schools can pick and choose what students they want to enroll, and they can remove students without providing an alternative education option.

Tax credits will benefit the wealthy

In Arizona, Louisiana and Virginia, states that have passed similar school privatization measures, more than 60% of all state tax credits are going to families with annual incomes over $200,000.

Additionally, these tax credits provide an incentive for donations to private school scholarships over other charitable giving, including donations to food banks, cancer charities, churches and other nonprofits. If a couple with a state income tax liability of at least $20,000 made a donation of $10,000 toward private school scholarships, they would receive a state tax benefit of $10,000. If the same couple made a $10,000 donation to a public school foundation, their tax savings would be no greater than $584.

Under LB 753, wealthy residents and corporations become the overwhelming beneficiaries of these tax credits, not necessarily kids in need of a great education.

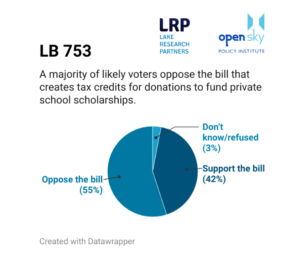

On Oct. 10, the Secretary of State’s office certified the results of a petition drive organized by Support our Schools Nebraska, a coalition led by the Nebraska State Education Association, to allow voters to weigh in on private school tax credits. Election officials verified 91,861 signatures, including more than 5% of registered voters in 64 of the state’s 93 counties. Just over 61,000 signatures were needed to place the question of repealing LB 753 on the 2024 General Election ballot.

Latest updates from OpenSky Policy Institute

Omaha World-Herald on Aug. 30: Nebraska petition to repeal new tax credit law surpasses signature goal

Supporters of strong public schools in Nebraska turned in 117,000 [...]

Associated Press on Aug. 30: Opponents of Nebraska plan to use public money for private school tuition seek ballot initiative

Supporters of strong public schools in Nebraska turned in 117,000 [...]