Nebraska’s tax system is upside-down, with affluent Nebraskans paying less than their fair share of household income in taxes relative to low- and middle-income families. Last year’s personal and corporate income tax cuts will widen that disparity.

The report’s key findings for Nebraska:

-

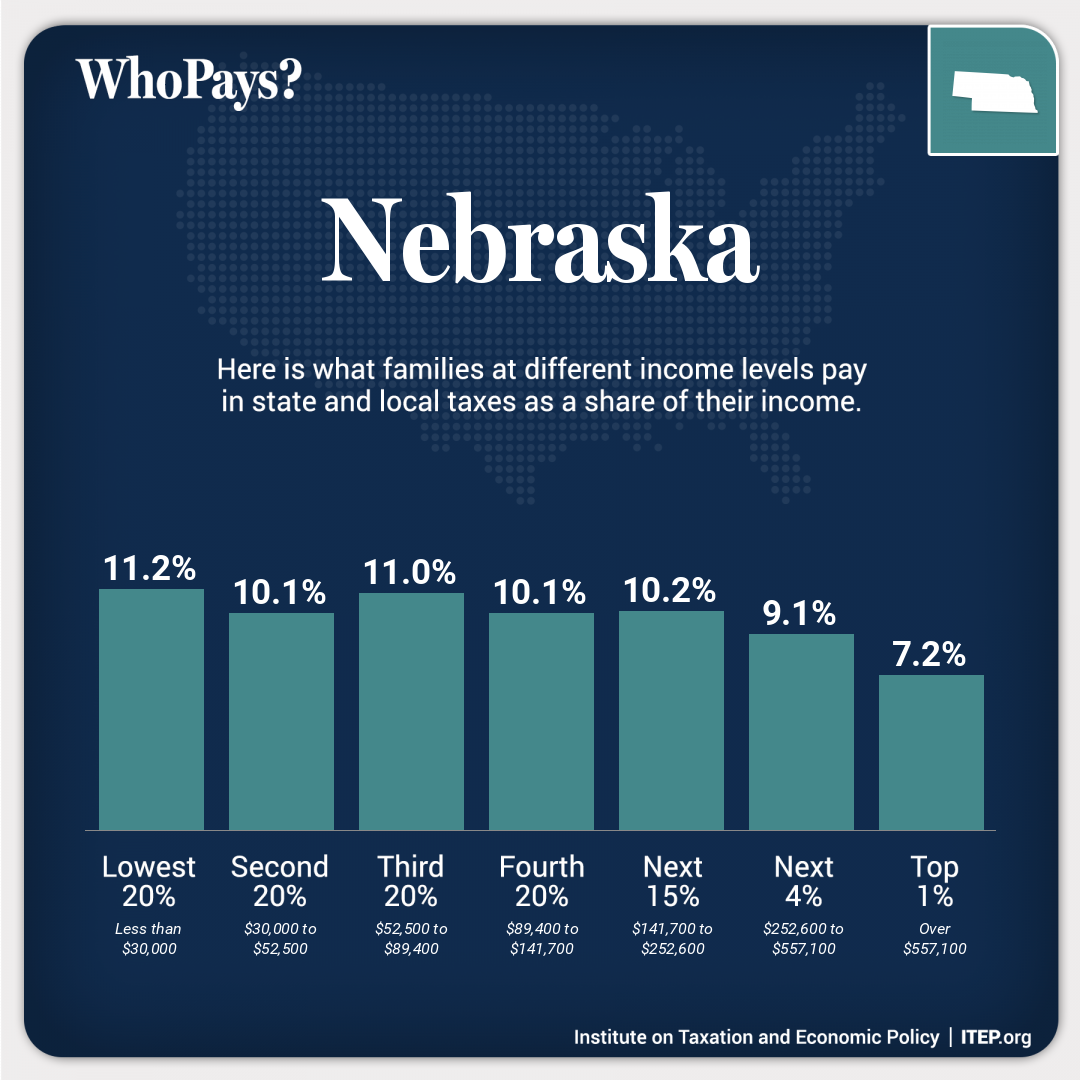

The lowest-wage 20% of taxpayers face an effective state and local tax rate that is 56% higher than the top 1% of households. The average effective state and local tax rate is 7.2% for the top 1% of individuals and families, 11% for the middle 20% and 11.2% for the lowest-income 20%.

-

Nebraska has the 30th most regressive tax system in the nation. If upcoming personal and corporate income tax cuts were fully implemented in 2024, they would drop Nebraska by 10 places on the ITEP Inequality Index to 20th most regressive. Florida tops the ranking of states with the most regressive tax codes, meaning its residents experience the greatest imbalance between wealthy and low-income households in what percentage of their income remains after taxes.

Nebraska, like many states with tax codes that already increase economic inequality, doubled down on regressive tax policies in recent years with deep tax cuts benefiting more affluent households and wealthy corporations. Such policy decisions obviously have implications for taxpayers but also for the revenue available to fund the schools, roads and public safety that Nebraskans rely on.

“At a time when Nebraskans feel financially stressed and the state’s coffers are abundant with funds from the federal government, reports such as this highlight a lost opportunity,” said Craig Maher, Director of the School of Public Administration at the University of Nebraska at Omaha. “Rather than utilize these one-time funds to redesign a tax system in a more progressive manner, state policymakers opted for the opposite – tax breaks that exacerbate regressive fiscal policies in Nebraska.”

As Nebraska policymakers in 2024 consider a shift to generate more revenue from sales taxes and less from property taxes, the report provides timely analysis of policy options that advance tax fairness versus those that ask even more of low-wage earners.

Sales taxes, based on spending rather than income or ability to pay, are the most regressive tax category and the most significant driver of economic and racial inequality in state and local tax codes. In Nebraska, low-wage families pay almost five times more as a share of their income in consumption taxes than the best-off families, and middle-income families pay four times the rate of the wealthy, the report finds.

Nationally, tax systems in 44 states exacerbate inequality by making incomes more unequal after collecting state and local taxes, while systems in six states plus D.C. reduce inequality, the report finds.

Examples of policies that lessen tax regressivity:

-

The least regressive tax systems have highly progressive income taxes and rely less on sales and excise taxes. Minnesota and Vermont top the list.

-

Washington shed its title as the nation’s most regressive tax state with enactment of a new tax on capital gains and a tax credit for low- and moderate-income families.

-

All 10 states with more equitable tax systems offer refundable Earned Income Tax Credits, and nine of the 10 offer refundable Child Tax Credits. The absence of a Child Tax Credit contributes to regressivity in Nebraska.

“The Who Pays? report is an incredibly valuable tool for those involved in state and local government and for those interested in state and local tax issues,” said Adam Thimmesch, a Professor of Law at the University of Nebraska whose research focuses on state tax policy. “In particular, the report helps to explain the regressive elements of states’ taxing systems in an easy-to-understand format and with a vast amount of data underlying its conclusions. The report is a must-read for those interested in state and local taxation and in state tax reform.”

Budget webinar on Wednesday

Join OpenSky Policy Institute and the Nonprofit Association of the Midlands for a virtual briefing on state revenue issues and the state’s budget at noon on Wednesday, January 10. Register today.