After forwarding a package of property tax breaks to a final round of consideration on Thursday morning, the Nebraska Legislature moved on to discussion of income tax cuts.

Under LB 754, the top personal and corporate income tax rates would be trimmed to 3.99% by 2027. The proposed cut is on top of legislation passed just a year ago to lower the top rate to 5.84%.

The income tax cuts, as proposed, along with accelerating full exemption of Social Security benefits and other provisions of LB 754, are projected to cost the state about $380 million in revenue over the upcoming two-year biennium. The revenue loss will expand through 2027.

When combined with the cost of property tax cuts, the significant loss in revenue could lead to cuts in important state programs, including education and workforce development, when the state faces an economic downturn.

This session, even as senators are working with a record budget surplus, the Legislature has sought to carve out revenue for the tax cuts by drawing from a number of cash funds and leaving less money in the rainy day fund. The Legislature relies on these funds as a cushion in years when working with a budget shortfall.

Amendments to the income tax cuts proposed Thursday eliminated provisions that would have largely benefitted wealthy taxpayers who itemize deductions as well as businesses seeking to fully expense certain property and research expenditures. But the bulk of the cuts proposed in LB 754 would still flow predominantly to wealthy Nebraskans and out-of-state corporations.

Tax credits remaining in the income tax package would help some Nebraskans with child care costs, but the amount pales in comparison to other provisions of the package.

‘Circuit breakers’ merit consideration

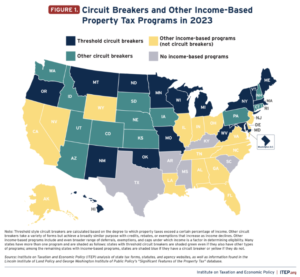

Lawmakers in Nebraska are currently considering property tax cuts but ignoring a solution that speaks more directly to questions of property tax affordability than any other policy option: the “circuit breaker,” which is the subject of a new report from the Institute on Taxation and Economic Policy.

What are circuit breakers? They work exactly how they sound: they prevent homeowners and renters from being “overloaded” by property taxes that go beyond what they can afford to pay. Under most circuit breakers, property taxes above a certain percentage of income are deemed unaffordable and credited back to the taxpayer.

On Thursday, the Nebraska Legislature advanced a package of property tax breaks, including additional funding for credits that show up directly on property tax statements and more money for state income tax credits on property taxes paid to K-12 schools and community colleges.

On Thursday, the Nebraska Legislature advanced a package of property tax breaks, including additional funding for credits that show up directly on property tax statements and more money for state income tax credits on property taxes paid to K-12 schools and community colleges.

The property tax package, LB 243, includes provisions of several bills proposed this year, but a circuit breaker outlined by Sen. Carol Blood in LB 211 was not advanced from the Revenue Committee. In LB 211, tax relief would be triggered when property taxes reached a certain percentage of a property owner’s or renter’s income.

Nebraska does have an existing program, the Homestead Exemption, which provides benefits to qualifying seniors.

“We see property tax cuts being touted all the time as ways to improve affordability, but more often than not they’re actually tilted toward the people who need them least,” said Carl Davis, ITEP’s research director and an author of the report. “If you’re trying to improve property tax affordability, there’s no policy better suited to the task than circuit breakers. It’s the only policy option that even tries to measure how much property tax a family can actually afford to pay.”