Corporate income tax cuts don’t cause economic growth

Download a printable PDF of this report.

Reducing corporate income taxes in Nebraska is not a strategy that will lead to more jobs and a strong economy.

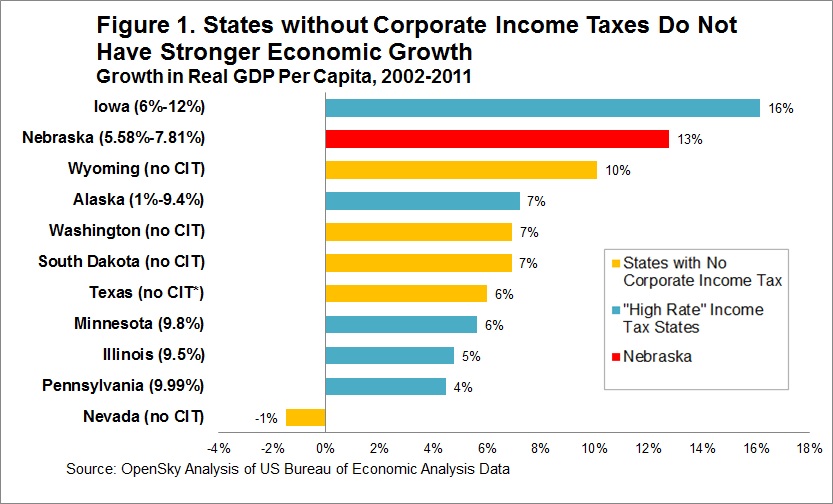

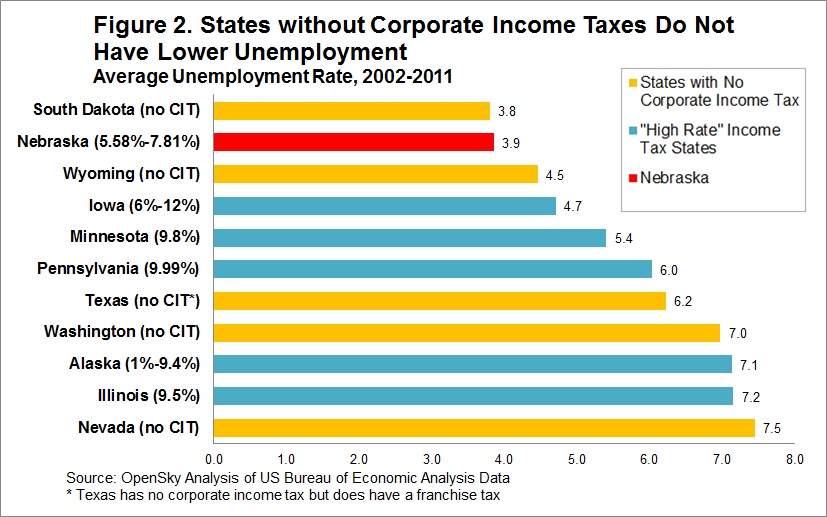

That’s because extensive data shows that no clear relationship exists between corporate income tax cuts and economic growth or employment.

Research has repeatedly found that state corporate income tax cuts have, at best, only a very small effect on state economic growth.[i]

Benefits of tax cut go to residents of other states

The vast majority of state corporate income taxes are paid by a small number of large corporations, most of which are publicly-traded multi-state corporations whose owners live elsewhere.[ii]

That is especially true in Nebraska because the state’s “single sales factor” policy (discussed below) comes close to eliminating corporate income taxation of companies that produce goods here but sell into nationwide markets.

That means most of the benefit of eliminating the tax would go to the owners and shareholders of these large corporations – most of who live in other states.

State taxes are not a big factor in business decisions

The state corporate income tax is a tiny fraction — only about one tenth of one percent — of total expenses for corporations that do business in Nebraska.[iii]

These taxes pale in comparison to other factors like the cost and quality of the labor market, proximity to customers, quality transportation, and access to supplies and materials.[iv]

In a survey of consultants who help businesses choose site locations matches, State corporate income taxes were not even in the top 10 site selection factors listed.[v]

Income tax doesn’t prevent hiring

Multi-state corporations in Nebraska are taxed based on the percentage of their total sales that takes place in our borders – not on such factors as the value of their facilities or what they pay in salaries.

That means these corporations already can build, expand and hire in the state and not incur any additional income tax liability.

Eliminating the corporate income tax is no incentive for these companies to increase hiring or investment in the state because their Nebraska taxes only increase if Nebraska’s share of their nationwide sales goes up.

Not only will there not be a tax-based incentive, but demand for products in Nebraska will likely go down under the measures being considered. That’s because approval of LB 405 and 406 would mean 80 percent of the state’s residents likely will see a tax increase after the shift from income to sales taxes.[vi] In other words, most Nebraskans would have less money to spend.

Eliminating the corporate income tax did not help other states

The only state to eliminate its corporate income tax in recent years is Ohio, which phased out its corporate tax beginning in 2005.

Reducing Ohio’s business taxes by more than $1 billion per year has not helped the state’s economy.

Ohio now has a smaller share of national income, employment and investment than when the plan was enacted.[vii]

Business tax credits would slash sales tax revenues

Presently there are $900 million in outstanding earned tax credits under the Nebraska Advantage Act and other incentive programs. Without a state income tax, sales tax revenues likely would have to be used to meet these commitments.

Nebraska corporations benefit from state investments

Companies that do business in Nebraska benefit from the investments we’ve made in education, a skilled workforce, transportation and safe communities. Nebraska’s high quality of life makes it attractive for businesses to be here. To keep the state attractive we need businesses to contribute their fair share. In fact, high-quality public schools are the number one quality of life factor in the businesses’ decisions to relocate, according to the consultants’ survey cited above.

While it is a small fraction of business expenses, the corporate income tax adds up to a significant source of revenue for the state that allow us to invest in like education and other services that promote jobs and a strong economy.

The elimination of the tax would likely reduce the revenue available for the state to invest in what truly matters for promoting widespread prosperity.

Eliminating the corporate income tax would be a bad deal for Nebraska and Nebraska businesses.

[i] See for example: James Alm and Janet Rogers, Do State Fiscal Policies Affect State Economic Growth? (Public Finance Review: July 2011); Donald Bruce, John Deskins, and William F. Fox, On the Extent, Growth, and Efficiency Consequences of State Business Tax Planning, in Alan J. Auerbach, James R. Hines, Jr., and Joel Slemrod, Editors, “Taxing Corporate Income in the 21st Century” (Cambridge University Press: 2007); and J. William Harden and William H. Hoyt, Do States Choose Their Mix of Taxes to Minimize Employment Losses? (National Tax Journal: March 2003). The studies that do find that state corporate income tax cuts can sometimes have a small positive effect on state economies over a long period of time (5-20 years) also tend to find that this only occurs if state services benefitting businesses are not cut and other state business taxes are not increased to keep state budgets in balance. It would of course be extremely difficult to meet this condition and still balance the state budget. And in the case of LB 405 and LB 406, the proposals increase sales taxes on businesses to offset the revenue loss from corporate income tax repeal, so this pre-condition for a positive impact will not be met.

[ii] See Nebraska Department of Revenue, “Analysis of Corporation Income Tax Returns for 2004,” http://www.revenue.ne.gov/ann_rept/06an_rep/Inc12-13.pdf. A rough estimate is that 80 percent of Nebraska corporate income taxes are paid by these out-of-state shareholders and owners.

[iii] Nationally, total state and local business taxes account for 2%-3% of business costs (Internal Revenue Service data). In Nebraska, corporate income taxes are 4% of total state and local business taxes (Council on State Taxation, Total state and local business taxes: State-by-state estimates for fiscal year 2011 (July 2012), http://www.cost.org/WorkArea/DownloadAsset.aspx?id=81797). 4% of 2%-3% is .08%-.12%.

[iv] Robert Lynch, Rethinking Growth Strategies: How State and Local Taxes and Services Affect Economic Development (Economic Policy Institute: 2004), http://www.epi.org/page/-/old/books/rethinking_growth_(full).pdf.

[v] Area Development Magazine, 8th Annual Consultants Survey (2012), http://www.areadevelopment.com/AnnualReports/Winter2012/8th-site-selection-consultants-RE-survey-results-28282888.shtml.

[vi] See our analysis of the distributional impact of LB 405 and LB 406 here: https://www.openskypolicy.org/80-percent-of-nebraskans-would-see-tax-increases-if-income-taxes-are-cut.

[vii] US Bureau of Economic Analysis data. From 2004 to 2011, Ohio’s share of US GDP dropped 11.2%, its share of US employment dropped 6.1%, and its share of US Personal Income dropped 7.4%. These results don’t prove that the change hurt Ohio’s economy, but they do not seem to support the claim that eliminating corporate income taxes leads to economic growth.