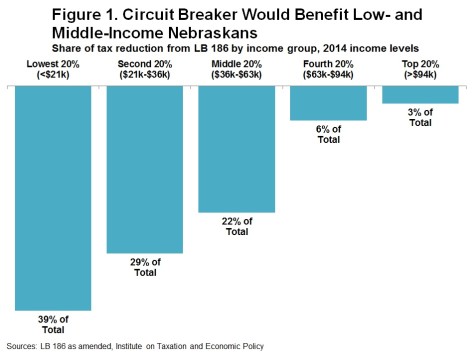

Policy Brief: ‘Circuit breaker’ in LB 186 provides targeted property tax reductions

Property tax “circuit breakers” like the one proposed in LB 186 are a way to provide targeted tax reductions to those whose property taxes are high in relation to their incomes.