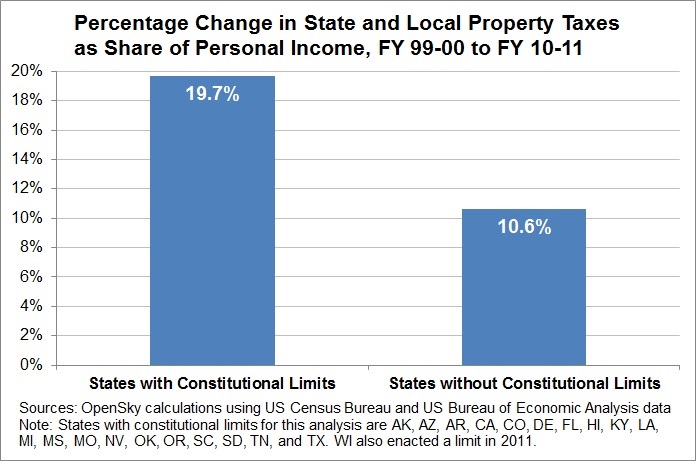

Property taxes have grown faster in states with tax and spending limits

Property taxes have grown faster in states with tax and spending limits As a follow up to our recent report that found spending growth caps in Nebraska would likely lead to higher [...]