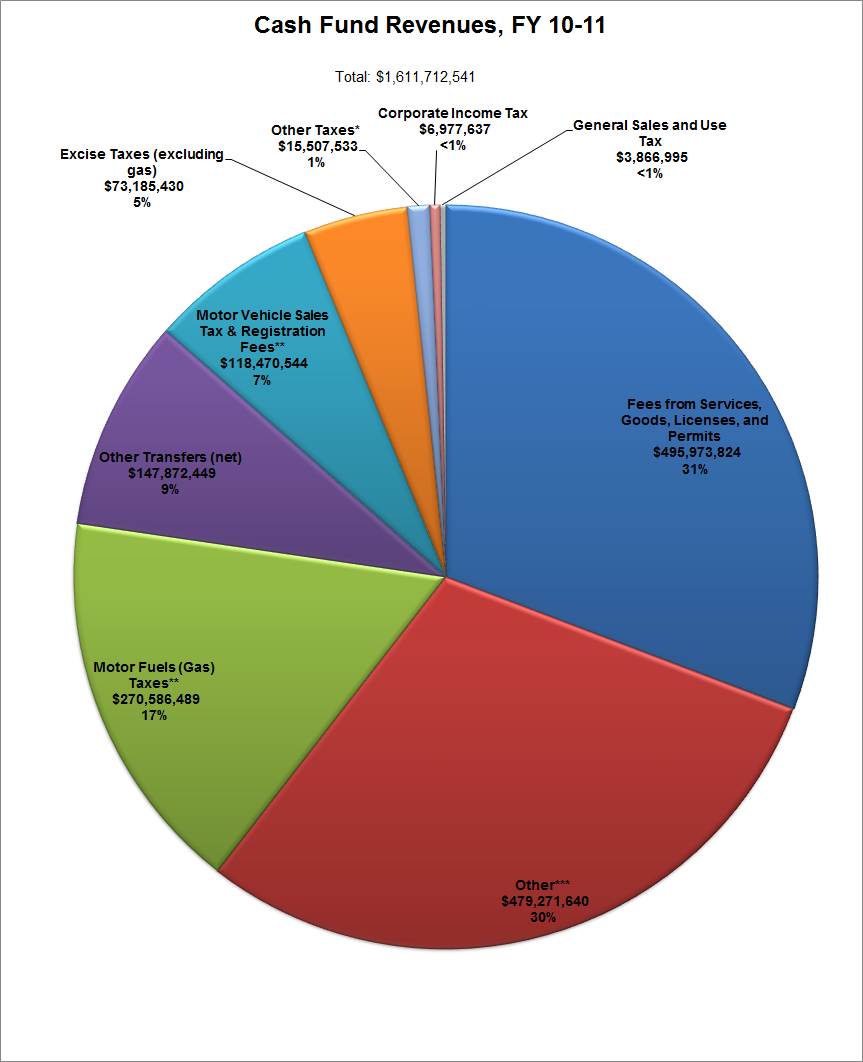

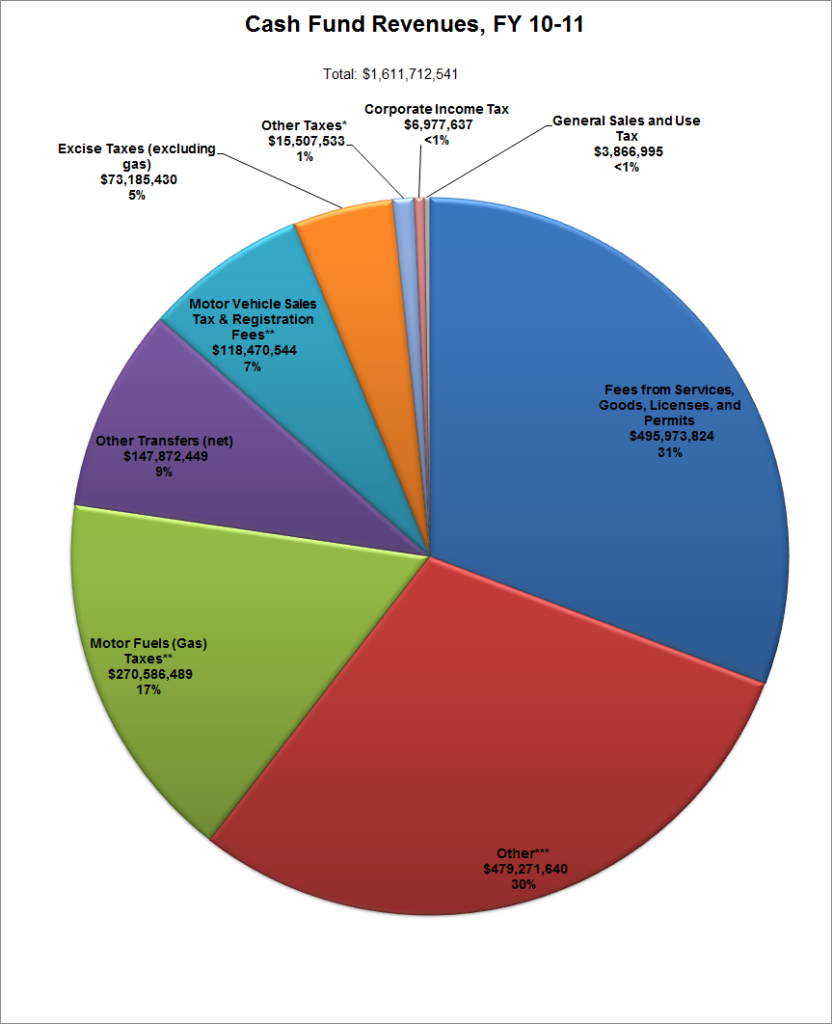

Cash Fund Revenues, FY 10-11

Note: this graph will be updated with FY 11-12 data as that information becomes available.

This graph shows Cash Fund revenues in FY 10-11, which come from taxes, fees, charges, and also transfers from other funds. Click here to see how Nebraska spends these Cash Funds. Or go back to Primer Extras: Chapter 3 – State Revenue.

*Other taxes are primarily Business and Franchise Taxes and special income taxes on fiduciary income and financial institutions

**Revenues from the gas tax, motor vehicle sales taxes, and vehicle registration fees are deposited in the Highway Trust fund and then transferred into Cash Funds for transportation needs; the figures here are the amounts transferred.

***Other includes intergovernmental revenue, proceeds from the sale of assets, miscellaneous revenues, and changes in fund balances

Source: Department of Administrative Services Accounting Division, Annual Budgetary Report (December 2011)