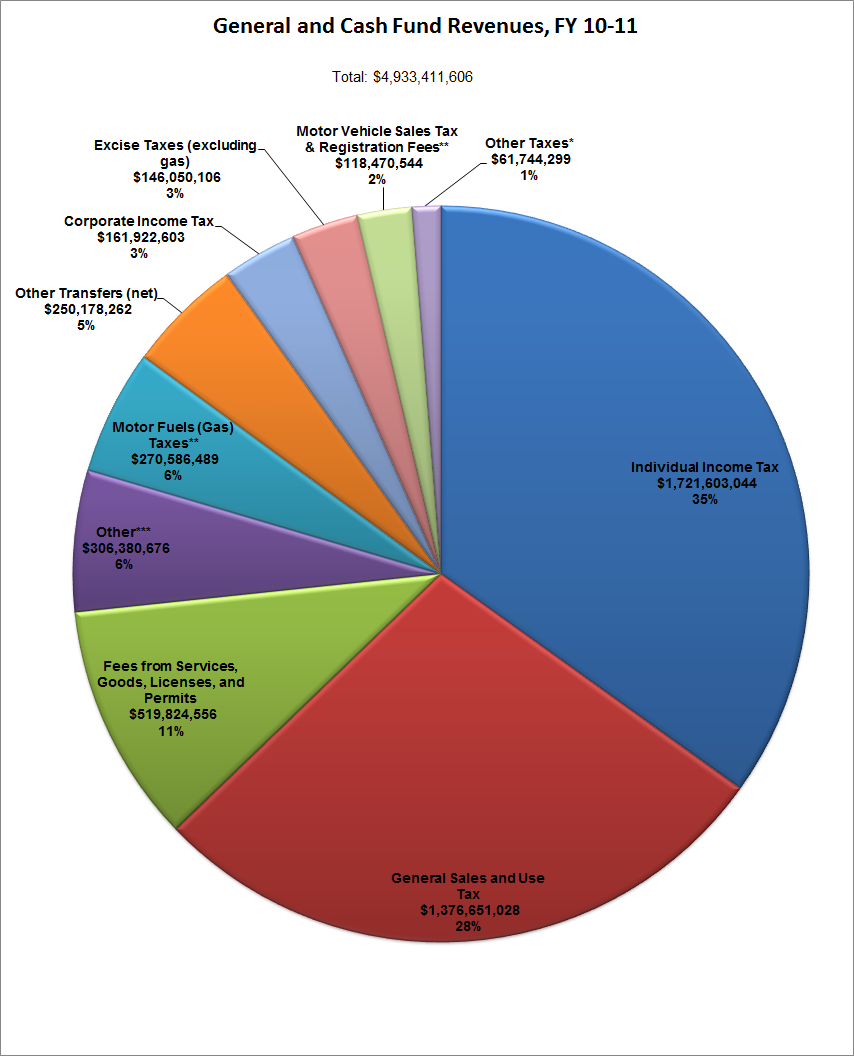

General and Cash Fund Revenues Combined, FY 10-11

Note: this graph will be updated with FY 11-12 data as that information becomes available.

This graph combines what might be considered “state-source” revenues — all taxes, fees, and other revenues that are collected in Nebraska and spent through the General Fund and Cash Funds. Click here to see how Nebraska spends these funds. Or go back to Primer Extras: Chapter 3 – State Revenue.

*Other taxes are primarily Business and Franchise Taxes and special income taxes on fiduciary income and financial institutions

**Revenues from the gas tax, motor vehicle sales taxes, and vehicle registration fees are deposited in the Highway Trust fund and then transferred into Cash Funds for transportation needs; the figures here are the amounts transferred.

***Other includes intergovernmental revenue, proceeds from the sale of assets, miscellaneous revenues, and changes in fund balances

Source: Department of Administrative Services Accounting Division, Annual Budgetary Report (December 2011)