Policy brief — LB 337 not aimed at middle class, small business

LB 337 provides a large tax cut to wealthy Nebraskans and does little-to-nothing for the middle-class or small businesses. The bill also would deplete the state of revenue needed for schools, public safety and other key services at a time when a key national report shows we could be entering a long run of budget shortfalls.[1]

Wealthiest Nebraskans get largest tax cuts

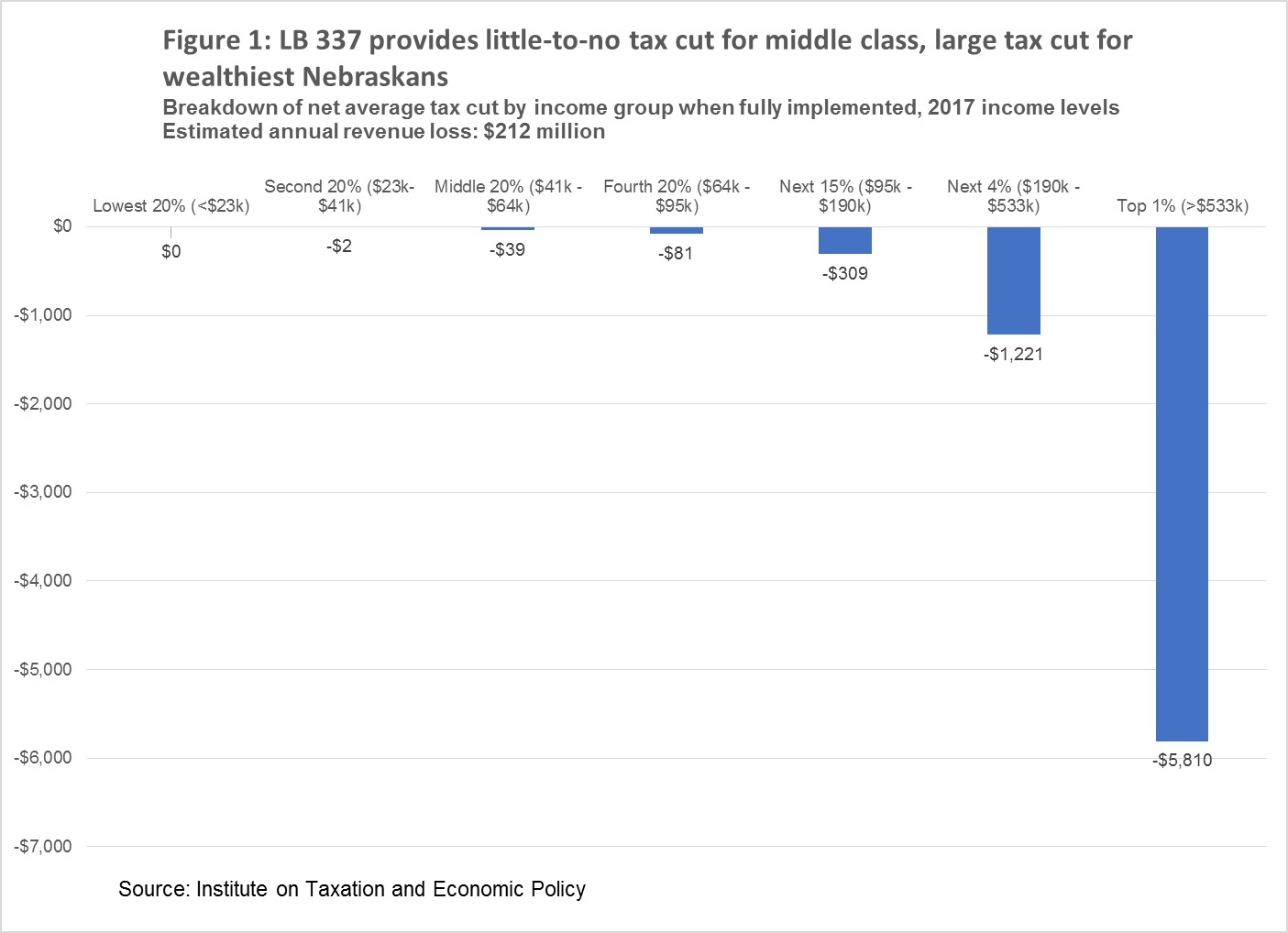

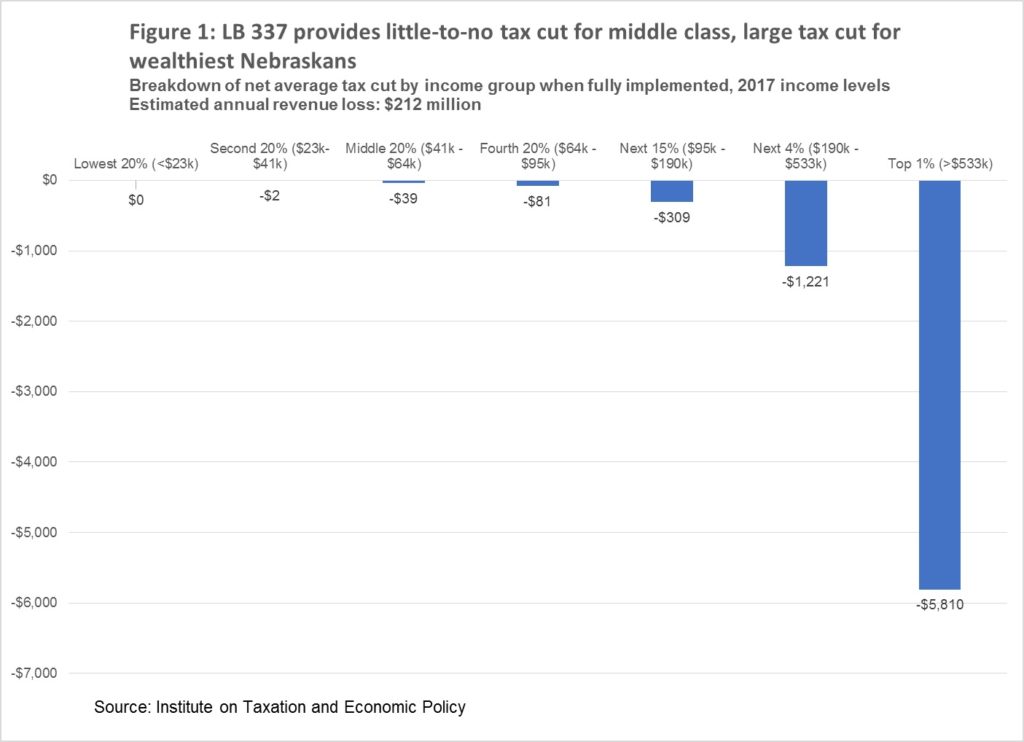

Institute on Taxation and Economic Policy (ITEP) data show that under LB 337, a Nebraskan in the top 1 percent of incomes would would receive an average tax cut of about $5,810 a year; a middle-income earner would receive about $39 annually on average; and the lowest-earning taxpayer would, on average, receive no tax cut. (Figure 1) About 86 percent of LB 337’s tax cut would go to the highest-earning 20 percent of Nebraskans with annual incomes greater than $95,000. Furthermore, about 33 percent of the tax cut will go the wealthiest 1 percent of Nebraskans, who on average earn about $1.6 million annually.[2]

Revenue loss would be significant and much of the tax cut would leave the state

When fully implemented, LB 337 would annually reduce revenue hundreds of millions of dollars. Annually, about $53 million – or about 25 percent — of the total income tax cuts would leave the state. The federal government would collect about $38 million more from Nebraskans who would have less state tax to write off on federal tax returns and another $15 million would go to non-residents who own stock in multi-state companies that do business in Nebraska.

Revenue triggers are not sound tax policy

Revenue triggers like the one proposed in LB 337 set tax cuts on autopilot based on arbitrary levels and don’t allow lawmakers to respond to state needs in economic slowdowns or natural disasters. A tax cut trigger in Oklahoma caused an income tax cut in 2016 just as oil prices plummeted. This has contributed to a budget crisis in which nearly one third of Oklahoma’s school districts moved to four-day school weeks.[3] LB 337’s trigger is based on projected revenue growth – not actual revenue growth. If the trigger proposed in LB 337 had been in place in Nebraska since 2001, several tax cuts would have been implemented, including one during the recession of the early 2000’s, one during “The Great Recession” and another last year that would have significantly exacerbated Nebraska’s current budgetary issues.

Tax cut not likely to deliver on economic promises, would hinder key investments

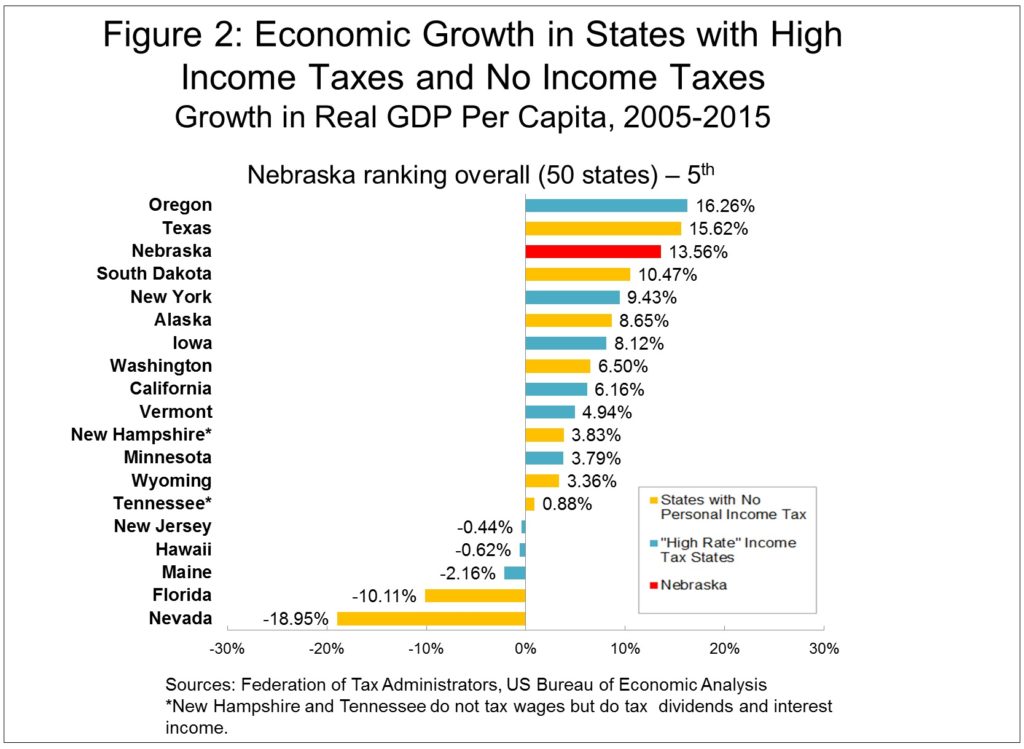

LB 337 has been proposed in the name of economic growth. Academic research, however, fails to find a consensus regarding a link between income tax cuts and economic growth.[4] For its part, Nebraska economically outperforms most states with lower or no income taxes (Figure 2) and had the fifth-fastest growing economy between 2005 and 2015. LB 337 would do little to help small businesses. Eighty-six percent of small businesses make less than $50,000 in total income. The average small business subject to the individual income tax has $27,484 in taxable income.[5] Such a business would receive no tax cut under LB 337. The revenue losses created by LB 337 would, however, impede Nebraska’s ability to invest in real economy builders like schools, public safety and infrastructure and also would prevent Nebraska from taking real steps to address our high reliance on property taxes to fund schools and other vital services.

Conclusion

LB 337 poses serious budgetary risks with little guarantee of economic reward. Furthermore, considering tax cuts in the face of major budget uncertainty at the state and federal level is not fiscally responsible. And while LB 337’s tax cuts are unlikely to strengthen our economy, they will harm Nebraska’s ability invest in real economy builders, address pressing issues like corrections and property taxes, and possibly leave us faced with dire consequences that have plagued Kansas and Oklahoma following their income tax cuts.

Download a printable PDF of this analysis.

_______________________________________________________

[1] U.S. Government Accountability Office, “State and Local Governments Fiscal Outlook, 2016 Update,” downloaded from http://www.gao.gov/assets/690/681506.pdf on Dec. 21, 2016.

[2] The average tax changes reflected here include the deductibility of state income taxes on the federal return, sometimes called the “federal offset.”

[3] CBSNews.com, “Okla. schools make tough cuts amid oil slump, budget cuts,” downloaded from http://www.cbsnews.com/news/schools-forced-to-shorten-school-week-amid-oil-slump-budget-cuts/ on Jan. 31, 2017.

[4] OpenSky Policy Institute, “Dr. McGuire: Research shows no conclusive link between taxes, economic growth,” downloaded from https://www.openskypolicy.org/dr-mcguire-research-shows-no-conclusive-link-between-taxes-economic-growth on Jan. 30, 2017.

[5] Office of Tax Analysis, U.S. Department of Treasury, “Methodology to Identify Small Businesses and Their Owners, November 2016,” downloaded from https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/TP4-Tables.xlsx on Feb. 2, 2017. Tables 2014-4 & 2014-6.