Policy brief: More about the gas tax and inflation

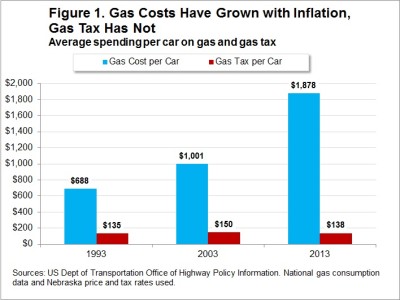

On average, Nebraskans paid nearly $1,200 more annually for gas per car in 2013 than they did in 1993.

However, in 2013, Nebraskans paid just $3 more in state gas taxes per car (Figure 1) than they did in 1993, and they actually paid $12 less than they did in 2003.

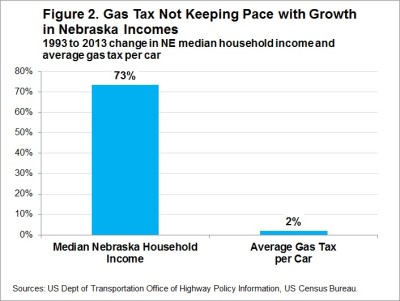

More specifically, the average annual cost for gasoline per car in Nebraska increased from $688 to $1,878 – or 173 percent between 1993 and 2013. The average cost of the gas tax in that same time span increased from $135 per car to $138 per car – a two percent increase. Meanwhile, the median Nebraska household income grew 73 percent (Figure 2).

These numbers further illustrate how the value of Nebraska’s gas tax has not kept up with inflation and the rising costs of construction and maintenance necessary to make important investments in our roads and bridges.

The Institute on Taxation and Economic Policy (ITEP) recommends increasing gas taxes to reverse their long-term declines and help bolster funds needed to build and maintain a strong transportation network.

Such an increase would occur under LB 610 – a bill that is headed to final round debate in the Nebraska Legislature.