OpenSky Analysis of Tax Cuts’ Impact on School Funding

During the general file debate of LB 970, a number of questions were raised about the current assumptions of TEEOSA growth in the next biennium and how changing those assumptions would impact the amount of funding available for LB 970.

Therefore, the purpose of this analysis is to address the impact of reducing TEEOSA growth to 3-5%, and whether a reduction in TEEOSA growth to 3-5% can free up enough funding for LB 970.

If LB 970 (as amended on general file) is passed AND NO other A-bills are passed from this point forward, it will still create a substantial budget shortfall over the next biennium. If we adjust projections to include a:

- 5% TEEOSA growth in the next biennium, the deficit will be $248 million; or,

- 3% TEEOSA growth in the next biennium, the deficit will be $196 million.

Below are our conclusions regarding the impact of limiting TEEOSA growth to 3-5%:

- In the context of the projected increase in TEEOSA, “growth” is a misnomer. TEEOSA funding was cut by nearly $100 million from FY11 to FY13. A 3-5% increase will take us back to 2010 levels, and is a cut relative to actual spending in FY11, despite normal increases in costs over the last several years.

- If the only A-bill to pass from this point forward is LB 970-A and TEEOSA is limited to 3% growth, there will still be a $196 million deficit in the next biennium. If TEEOSA is limited to 5% growth, the deficit in the next biennium will be $248 million.

- If all other A-bills on Select File and Final Reading as of today also become law, the deficit will increase to $243 million with 3% TEEOSA growth and $295 million with 5% TEEOSA growth.

- If the legislature chooses not to extend the increased Local Effort Rate, the ability of K-12 schools to offset general fund reductions through local support will be limited, leading to increased class sizes and other cuts. However, an extension of this provision will result in higher property taxes in many districts.

- If the .5% Cost Growth Factor is extended, the shortfall in the next biennium will be significantly reduced; however, this will, in effect, ignore the needs of the school districts. For example, schools employed over three hundred fewer teachers and instructional support staff in 2010-11 than in 2009-10[1]. The number employed in 2011-12 is expected to drop another 300 as a direct result of reductions in state aid.

- If LB970 is enacted and the Local Effort Rate in LB235 is extended, the tax cut in LB 970 ($89 m), is essentially paid for by increasing the Local Effort Rate ($98m), which will come largely from property tax increases.

TEEOSA in a historical context

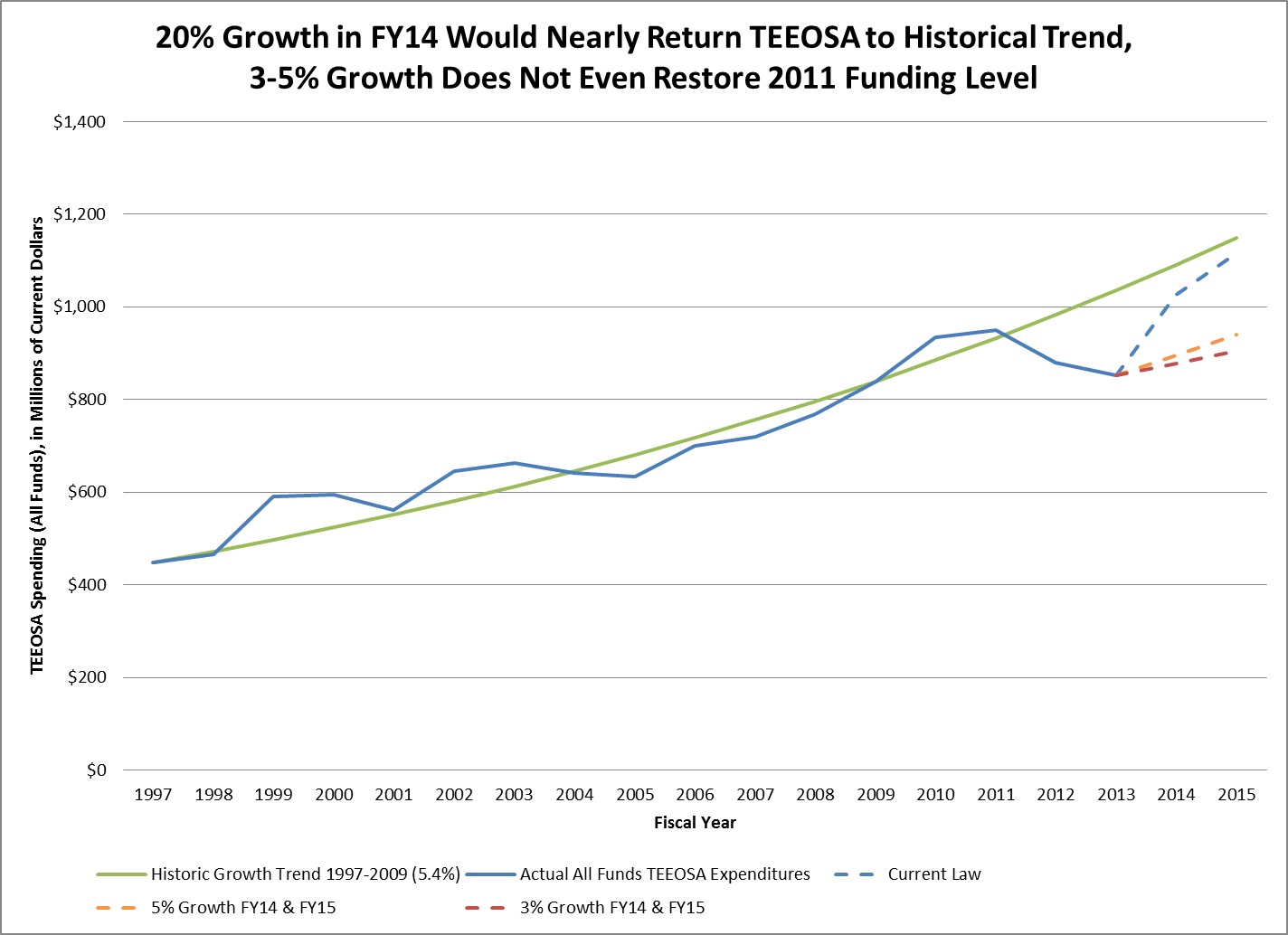

From 1997 to 2009, the historical growth rate of TEEOSA has averaged 5.4%.[2] During that time, TEEOSA expenditures have grown in every year except for FY’s 2001, 2004, and 2005; in these years, TEEOSA expenditures were reduced.[3]

TEEOSA expenditure reductions have historically been followed by significant increases, bringing growth up to normal levels. In FY01, a 5% cut was followed by a 15% increase in FY02. In FY’s 04/05, a 4% cut was followed by a 10% increase in FY06. Therefore, it follows that the 10% cut experienced in FY’s12/13 would be made up with a 20% increase as currently projected in FY14.

While this increased growth in the next biennium would make up much of the loss since general fund appropriations for TEEOSA began to drop in FY 10, even a 20% increase still wouldn’t quite bring TEEOSA up to historically expected funding levels.

Conversely, limiting TEEOSA to 3% growth in the next biennium would result in a 5% cut relative to spending in FY11, and 5% growth would amount to a 1% cut. TEEOSA funding would shrink to FY10 levels, despite increases in enrollment, salaries, healthcare and other costs. Taken one step further, if the historic growth rate had been sustained through the recession, 3% growth in the next biennium would amount to a 21% cut in FY15, and 5% growth would amount to an 18% cut.

It is also important to note that federal stimulus funds in FY’s 10-12 allowed the state to replace general funds with federal funds, so that general funds could be freed up to help fund other areas of government during the recession. When federal stimulus funds dried up, we fell off the infamous cliff, and TEEOSA sustained almost $100 million in cuts from FY11 to FY13. While 20% growth sounds like huge growth, it simply would help TEEOSA start climbing back up to where it fell from.

LB 235 (2011)

LB 235 was adopted last session in order to adjust the TEEOSA formula and reduce state expenditures in the face of a continued recession and the end of federal stimulus money. 69% of the growth in TEEOSA aid in the next biennium directly relates to the expiration of some of the provisions in LB 235.[4]

A key component of LB 235 was the increase of the Local Effort Rate, which requires a larger local effort to offset some of the loss of state funding. The Local Effort Rate is set to drop from $1.0395 back to its previous level of $1.00, at a cost of $98 m over the next biennium.

The other notable piece of LB235 was a reduction of the Cost Growth Factor to 0% in FY12 and .5% in FY13. With the expiration of this provision, the Cost Growth Factor is set to increase, costing $205 million over the biennium. Even if school spending lids remain at LB 235 levels, schools’ costs will continue to grow. For example, K-12 enrollment growth alone is expected to average more than .5% per year.[5] The end result is a growing gap between schools’ actual costs and state support.

Our conclusion is that a reduction in TEEOSA growth to 3-5% will not only harm the quality of K-12 education in our state, it alone cannot free up enough funding to make LB 970 affordable. If LB 970A is the only A-bill that is passed for the remainder of the session, limiting TEEOSA growth to 5% will still yield a deficit in the next biennium of $248 million, or $196 million if TEEOSA is limited to 3% growth.

* $58.6 million was awarded to Nebraska through the Education Jobs Act in FY11, but the money was spent in FY12, so it appears here in the year it was spent.

[1] 2011 Nebraska Department of Education Personnel Report

[2] OpenSky Analysis of the Legislative Fiscal Office 2010 Budget Report

[3] For background on TEEOSA statistics throughout this memo, see Table on page 3 and Graph on page 4.

[4] OpenSky Analysis of Appropriations Committee Budget Recommendations, March 2012

[5] National Center for Education Statistics, Projections of Education Statistics to 2019