It’s often said in policy circles that a state’s budget is its moral document. With debate set to begin on Nebraska’s budget on Wednesday, there are several things OpenSky will be watching to see how choices made in the Legislative over the next month align with what residents of our state value.

The budget, as proposed by the Appropriations Committee, outlines $5.3 billion in spending from the state’s General Fund in each of the next two fiscal years. It’s a huge sum of money that offers great opportunities to grow our state through investments in services like education and infrastructure that are essential to our economy.

Investments that benefit all Nebraskans

Nebraska is in an extraordinary revenue position, with federal stimulus contributing to a record surplus. The opportunity exists for targeted one-time investments to benefit all residents and help the state to grow.

Two of the big ticket items proposed by the Governor and outlined by lawmakers are a $1.25 billion transfer into an Education Future Fund, a commitment to heighten K-12 public education funding in Nebraska, and $575 million for the proposed Perkins County canal, which conversely represents a project filled with uncertainty.

Experts say that the greatest challenge facing Nebraska’s economy is a workforce shortage, an area where more targeted investments could reap greater dividends.

What’s left for the floor?

The budget bills from the Appropriations Committee leave $715 million for other uses – including proposed tax cuts – while maintaining a rainy day fund of $1.026 billion.

Participating in an OpenSky webinar highlighting the budget bills on Monday, Sen. Myron Dorn (LD 30) said debate beginning Wednesday will determine the priorities for those available funds. Will senators support increases in Medicaid provider rates proposed by the Appropriations Committee? Will they invest in families and workforce development by helping to grow the stock of affordable housing and designating funds from the Temporary Assistance for Needy Families program to support local food banks?

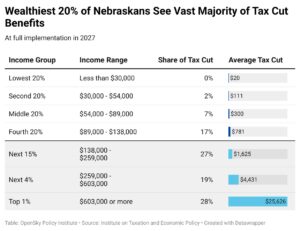

Or will the Legislature go all in on proposed state income tax cuts and extended property tax credits that predominantly benefit the wealthy, corporations and property owners? At full implementation, three-quarters of the income tax cut benefits proposed in LB 754 would go directly to the top 20% of Nebraska income earners.

Sustainable tax policy

The Legislature is tasked only with passing a balanced budget for the next two years, but provisions in bills to cut personal and corporate income taxes and extend property tax credits escalate the loss of funding available for essential services that make Nebraska a great place to work and live through 2029.

Long-term commitments such as these simply shift the responsibility for sound fiscal decisions to future state senators who, when faced with revenue reductions, would likely have to cut services that all Nebraskans depend on or look to sales tax increases that burden hard-working families.

Maintaining commitment to education

The transfer to the Education Future Fund is a significant step in Nebraska investing more in K-12 public education.

Maintaining that funding, however, will take a long-term commitment, and the additional investment in educating Nebraska’s students comes with strings attached for the state’s school districts.

In many cases, the additional funds provided by the state simply represent a tax shift, as provisions of the property tax proposal place caps on what revenue school districts can draw upon to pay teachers, provide transportation and educate students.

There are similar changes proposed for community colleges, with plans to shift funding from property taxes to state investments. Will senators be able to keep that commitment when revenues drop?

And at the same time state revenues are running strong, the state’s university system is looking to make budget cuts. A strong education system is key to workforce development both by educating Nebraska’s students and drawing top talent from outside the state.

The bottom line

Already this session, we’ve heard certain budget proposals, the tax cuts and some other measures referred to as “the package,” indicative of plans that go together.

Already this session, we’ve heard certain budget proposals, the tax cuts and some other measures referred to as “the package,” indicative of plans that go together.

Yet certain proposals don’t add up, like pledging $96 million more to build a new state prison but not adequately investing in services for people in the Corrections System. Or income tax cuts that would direct 28% of the benefits to the top 1% of income earners?

A lot is at stake as the budget debate begins and discussion continues on the tax cuts this month. When all is said and done and senators head home at the end of the session, Nebraskans will look at the “package” to define what the priorities of this year’s Legislature really were.