Provisions of the income tax package under consideration in the Nebraska Legislature predominantly benefit high-income taxpayers.

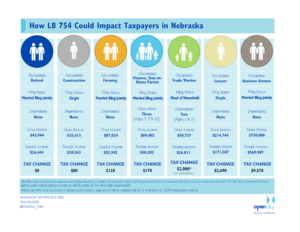

With debate on LB 754 set to begin on Wednesday, we looked at how model taxpayers in Nebraska would benefit under elements of the income tax package that can be projected.

A family of five with a middle-income wage earner and a stay-at-home parent caring for three children would see a tax benefit of $170.

This year’s tax package would expand on cuts made last year, taking both the top individual and corporate income tax rates to 3.99% by 2027. Currently, the top rate is to drop to 5.84% over the next several years.

Considering the entire package, the top 1% of Nebraskans (incomes of more than $600,000) see a cut more than five times greater than any other resident. For the lowest wage earners in Nebraska, any significant benefit that working families would receive directly is likely tied to the portion of the child care tax credit capped at $15 million a year.

Families with a household income of up to $75,000 could get an annual tax credit of $2,000 per child. For families with incomes between $75,000 and $150,000, the credit would be $1,000 per child. At most,15,000 Nebraska kids in child care could benefit.

The state’s strong financial position and our current budget surplus are largely attributable to federal stimulus, rather than past fiscal discipline by the state of Nebraska.

The cost of further cutting the top income tax rate alone is at least $700 million a year. By further restricting the state’s ability to raise revenue, Nebraska may find it difficult in the future to support vital services such as K-12 education, health care and public safety that provide a foundation for shared prosperity for all.