Policy brief – Adjusting to federal tax changes

On today’s Legislative agenda is LB 1090, a bill that would adjust Nebraska’s tax code to compensate for the effects of recent federal tax cuts. The Department of Revenue estimates that without any adjustments to the state tax code, Nebraska would expect to see a $327 million increase in state revenue in FY 18-19 and increases of more than $250 million in each of the next two years. Nebraska taxpayers, on the other hand, would face state tax increases because of the federal changes.[1] It’s important to protect Nebraskans — particularly low- and middle-income residents – from seeing state tax increases because of federal tax cuts. LB 1090, however, leaves no state revenue cushion if state revenue is less than projected due to the impact of the federal tax cuts.

What LB 1090 changes

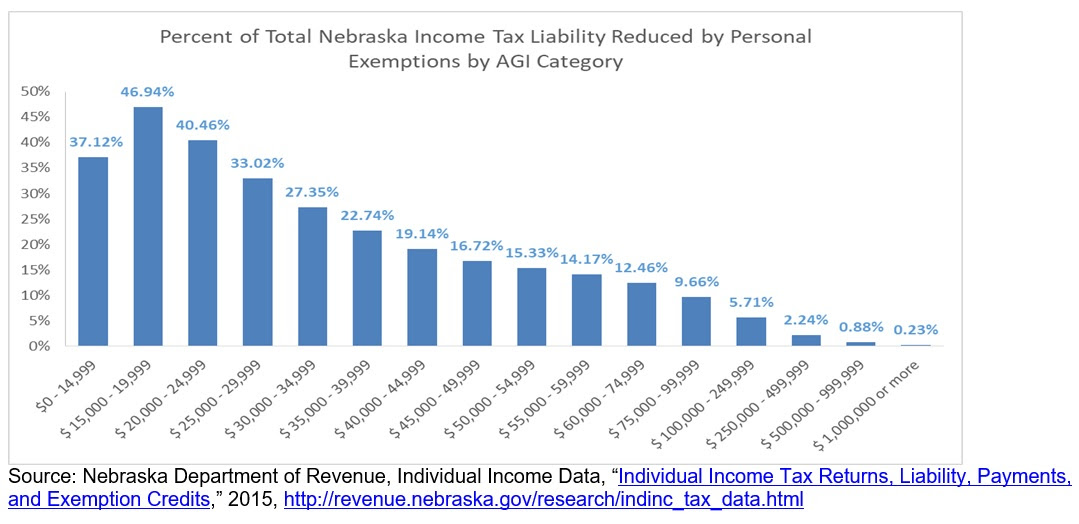

Nebraska taxpayers currently receive a non-refundable personal exemption credit for themselves and their dependents against their income taxes. In 2018, the credit is equal to $134 per person. For a family of four, this would be worth $536. Department of Revenue data show the credit particularly helps low- and middle-income Nebraskans (See chart below). The credit would be effectively eliminated by the federal tax changes if the state takes no action to adjust its tax code. The elimination of this credit makes up the bulk of the state tax increases anticipated by the Nebraska Department of Revenue.[2] LB 1090 attempts to prevent increasing state income taxes on Nebraskans by preserving the personal exemption credit for all taxpayers. LB 1090 also would increase Nebraska’s standard deduction and would retain our current inflation calculation method rather than chained CPI adopted under federal law, which grows more slowly.

LB 1090 leaves no state revenue safeguard

The changes proposed in LB 1090 leave the state no revenue cushion should estimates regarding the state fiscal impact of federal tax cuts not be spot on. This could be setting Nebraska up for continued budget problems given the tremendous uncertainty and many questions about the impact of the recent federal tax cuts. For example, it’s hard to tell the rate at which people will continue to itemize. Will businesses change their filing status from S-corps to C-corps? How will corporate taxpayer behavior change? The federal tax cuts have altered the fiscal tax policy landscape so considerably that it is hard to predict how everything will ultimately shake out. For all of these reasons and more, it is a difficult job for the Department of Revenue to estimate the total fiscal impact on the state of Nebraska. If the state revenue impact ends up being different than projected, LB 1090’s changes could leave lawmakers faced with having to either increase other revenue sources such as sales taxes or fees or make cuts to key services like education and health care.

Lawmakers can provide safeguards against budget cuts, increases in other taxes and fees

Lawmakers could amend LB 1090 to provide the state with a revenue safeguard should state revenues come in lower than projected due to the impact of the federal tax cuts. For example, lawmakers could preserve the personal exemption credit for low- and middle-income residents and not restore it for high-income residents, who are already receiving large federal income tax cuts. This would prevent tax increases for most Nebraskans while potentially leaving the state less vulnerable to revenue problems if the impact of federal tax cuts differs from projections. Maintaining the state’s current standard deduction also could offset revenue losses that might occur should the fiscal impact of federal cuts not match projections.

Conclusion

It is important to prevent Nebraskans – particularly low- and middle-income residents – from experiencing state tax increases because of federal tax cuts. It also is important that key services such as education, health care and roads be protected from additional funding cuts should the state impact from federal tax cuts differ from projections. LB 1090 could be amended in a way that prevents tax increases for most Nebraskans while also protecting the key services that are essential to our state and its economy.

Download a printable PDF of this analysis.