Policy Brief: ‘Circuit breaker’ in LB 186 provides targeted property tax reductions

Property tax “circuit breakers” like the one proposed in LB 186 are a way to provide targeted tax reductions to those whose property taxes are high in relation to their incomes.

They are called “circuit breakers” because the tax credits are triggered once property taxes reach a certain percentage of a person’s income, similar to how electrical circuit breakers are triggered when electricity surges. The tax reduction comes in the form of an income tax credit that helps offset the cost of property taxes.

Specifics about the LB 186 circuit breaker

The circuit breaker proposed in LB 186 would provide property tax reductions in the form of income tax credits and could replace the existing Property Tax Credit program.

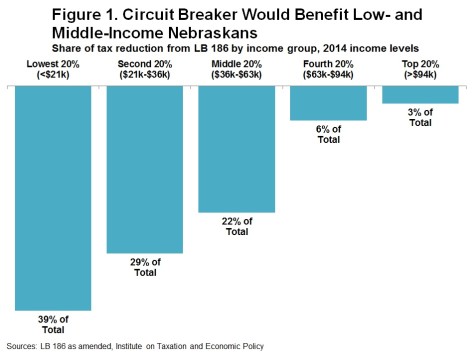

The majority of the tax reduction through the LB 186 circuit breaker would go to low- and middle-income Nebraskans (Figure 1). Renters would benefit as well, as LB 186 recognizes that about 20 percent of rent goes toward property taxes. This is in contrast to the Property Tax Credit Program, through which renters receive no direct tax reduction.

The circuit breaker also uses graduated rates, similar to income tax brackets, to better target the property tax assistance.

With the implementation of a circuit breaker similar to the one proposed in LB 186, a couple that owns a home, has three children and earns $66,545 annually would receive a $300 property tax reduction.[1] The same family would receive a $96 tax credit under the existing Property Tax Credit Program.

A renter who earns $19,618 annually would get a $485 property tax reduction under LB 186’s circuit breaker but would receive no direct property tax reduction under the existing Property Tax Credit program.

A home-owning couple with three children and an income of $359,068 annually would not receive a property tax reduction under the circuit breaker, but they would receive $121 under the existing Property Tax Credit Program.

More about circuit breakers

Eighteen states and the District of Columbia offer circuit breaker programs similar to that proposed in LB 186. Twelve other states provide property tax credits for low-income families based on income only, without consideration of the property tax-to-income relationship.[2]

Circuit breakers as a means to provide property tax reductions have garnered support across the country and in Nebraska. They were mentioned as a possible solution to Nebraska’s property tax challenges in the Tax Modernization Committee Final Recommendations in 2013[3] and in a December Revenue Committee report on property taxes.[4]

Conclusion

During the Tax Modernization Committee hearings in 2013, Nebraskans from all parts of the state made it clear property taxes were their main concern when it came to taxes. As the state looks at ways to address these concerns, LB 186 provides targeted property tax reductions to those who need it most.

Download a printable PDF of this analysis.