A quick look at the Revenue Committee tax plan

On Wednesday, the Revenue Committee advanced LB 461, a tax package that would start by cutting the top corporate income tax rate and collapse the first two personal income tax brackets. It also phases out the personal exemption credit for high income earners, slightly increases the earned income tax credit, eliminates the Nebraska Job Creation and Mainstreet Revitalization tax credit and suspends the New Markets Job Growth tax credit.

Starting in 2020, it phases-in cuts to the top personal and corporate income tax rates when projected revenue growth exceeds 3.5 percent and 4 percent respectively. The bill also replaces the assessment method of agricultural land from market value to income-capacity, caps the annual aggregate growth of agricultural land valuation and dictates that agricultural use value must fall between 55 percent and 65 percent of market value.

According to the Legislative Fiscal Office, the bill will reduce revenue by over $458 million by FY28 if tax rate reductions occur every year.

“A fundamental flaw with LB 461 is that it increases demand on state aid to K-12, while reducing state revenue,” said Renee Fry, executive director of OpenSky Policy Institute. “The two are not compatible. As a result, the bill will result in higher property taxes and/or significant cuts to K-12 funding.”

Furthermore, LB 461 would use revenue triggers that are based on projected revenue growth, Fry said, noting that had the bill’s triggers been in place since 2001, they would have caused income tax cuts twice during recessions and another last year that would have significantly exacerbated our current budgetary woes.

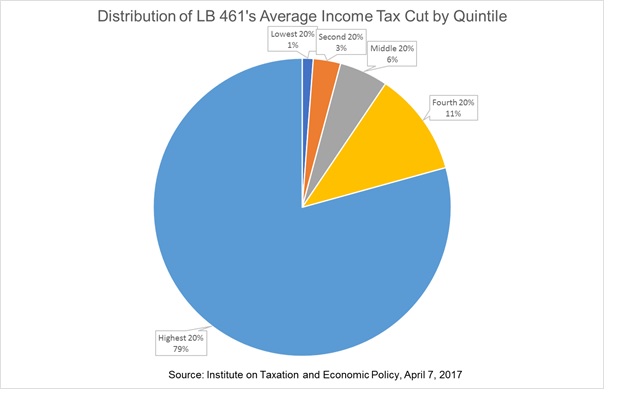

“This tax package is irresponsible policy. It does little to help the middle class or reduce pressure on property taxes. The real winners under LB 461 are those with very high incomes,” Fry said. (See image above.)

OpenSky will soon release a more complete analysis of LB 461.